On March 29, 2024, the Organization for Cross-regional Coordination of Transmission Operators (OCCTO) released its Aggregation of Electricity Supply Plans for FY2024, a compilation of electricity supply plans submitted by 1,902 electric utilities.

These supply plans prepared by electric utilities show their planned supply of electricity and the development of power sources and transmission lines for the next 10 years (from FY2023 to FY2033).

At 2023’s COP28 conference, a goal of tripling global renewable energy by 2030 was agreed upon, and G7 countries have also agreed to achieve a “fully or predominantly decarbonized power sector by 2035”. However, Japan’s stance toward these goals is being questioned.

Despite Japan committing to these goals, according to the published plans, even in 2033 coal will have only slightly decreased from the current level, and renewable energy will have only slightly increased, indicating that not only international targets, but also the achievement of Japan’s 2030 energy mix targets is in serious jeopardy.

Coal expected to account for 29% of Japan’s energy mix in FY2033

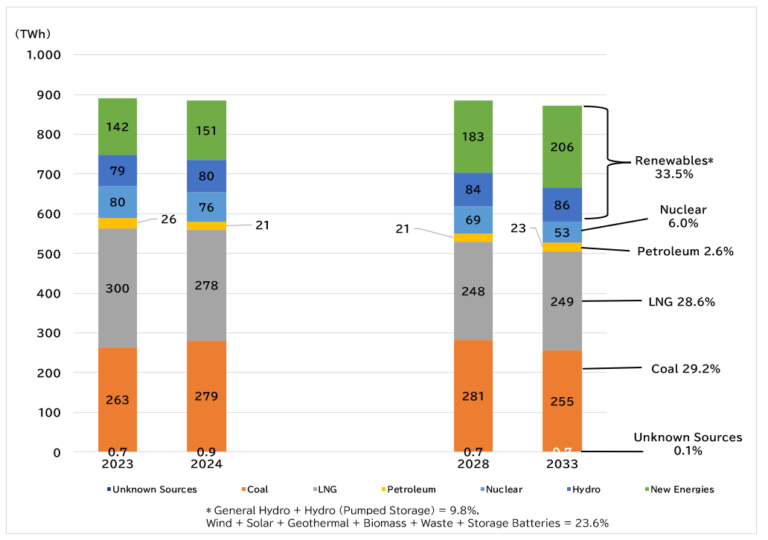

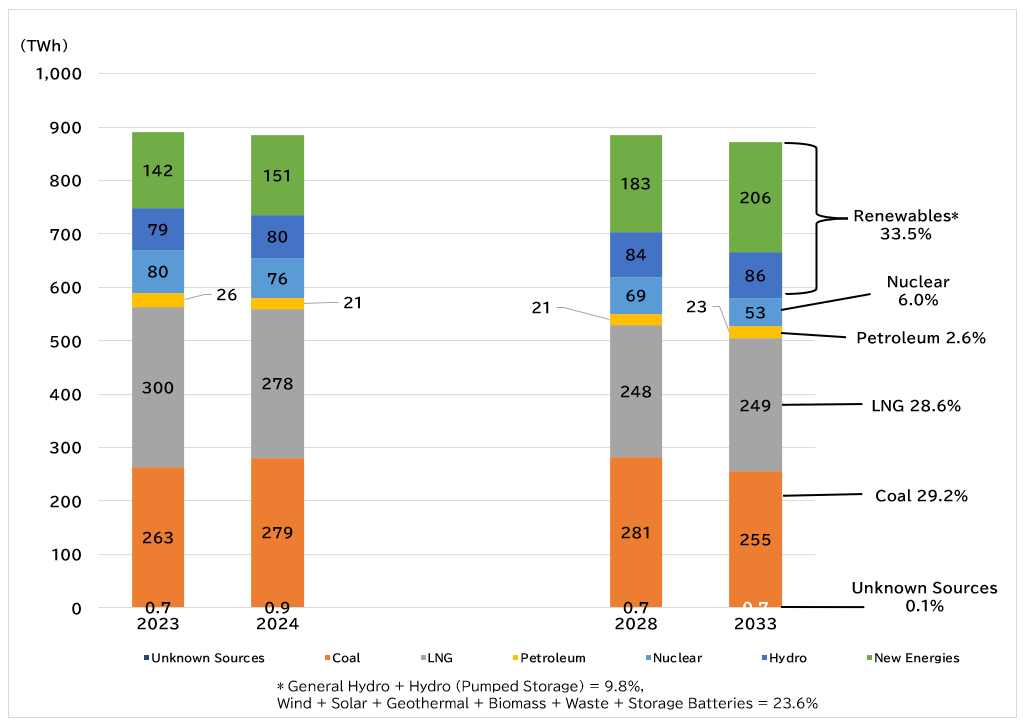

From the trends and forecasts of the aggregated transmission-end electricity supply shown in this Aggregation, Kiko Network has calculated the power supply composition for the FY2033 as follows:

In OCCTO’s Aggregation published last year, the ratio of coal in FY2032 was expected to be 32%. The forecast for FY2033 released this time is 29%, a decrease of 3%, but still far from the national target for FY2030* of 19%. While other countries are already moving away from fossil fuels – including not only coal, but also LNG (gas) and petroleum – Japanese electric utilities are expected to remain heavily dependent on fossil fuels (29% coal and 28% gas) 10 years from now.

Renewable energy is projected to be 33.5% of the energy mix in FY2033 (including waste and storage batteries). However, the national target for renewable energy in FY2030 is 36~38%*, indicating that the current submitted plans do not meet Japan’s FY2030 renewable energy target, even in FY2033.

※ National energy mix targets set in Japan’s 6th Strategic Energy Plan:

Renewables: 36-38% (geothermal, biomass, wind, solar, hydroelectric)

Coal: 19%

LNG: 20%

Petroleum, etc.: 2%

Nuclear: 20-22%

Hydrogen/ammonia: 1%

Projected transition of electricity generation (net) by power generation source

Coal-fired power capacity finally sees a decline, but LNG’s increases

Total installed capacity (output of power generation facilities) is expected to increase over the next 10 years.

Hydroelectric and nuclear power are projected to remain flat, but the installed capacity of new energy sources (wind, solar, geothermal, biomass, waste, storage battery) is expected to increase by approximately 40,000 MW.

To prevent further global warming, the installed capacity of thermal power must be drastically reduced as soon as possible. The installed capacity of coal-fired power, which had previously been increasing, is now expected to decline (by about 2.3 MW). Oil is also decreasing. However, LNG is scheduled to increase by approximately 4,100 MW.

Installed capacity (National total)

Power plant construction and retirement plans show no change in power suppliers’ coal dependency

As of April 2024, there are 166 coal-fired power plants operating in Japan (excluding mothballed units). To avoid the worst impacts of climate change, the government must set a target to completely phase out coal-fired power by 2030 and should have already started to retire many of Japan’s existing coal-fired power plants. However, only eight coal plants are planned to be phased out by FY2033 – less than 5% of the total number of Japan’s coal-fired power plants. This also puts Japan’s 2050 net zero target at significant risk.

The number of planned new coal-fired power units was reduced from three in the previous year’s Aggregation to zero. Unfortunately, this is because three new units (Saijo Unit 1 and Yokosuka Units 1 and 2) began operation in FY2023.

*Additionally, plans for new coal-fired power facilities are still underway. There is still a plan to construct a new coal gasification facility at the Matsushima Thermal Power Station Unit 2 in Matsushima, Nagasaki Prefecture (known as the “GENESIS Matsushima Project”). Please see here for more information about this plan.

Coal-fired power generation, regardless of its efficiency, emits substantial amounts of CO2, and it is emphasized that coal-fired power should be phased out by 2030 in developed countries in order for the world to avoid the worst impacts of climate change. Japan’s system of coal dependency is, in the words of UN Secretary-General Guterres, a “highway to climate hell with our foot still on the accelerator”.

Furthermore, in an opinion submitted to the Ministry of Trade, Economy, and Industry (METI), OCCTO states that, based on the results of successful bids in the capacity market and other factors, the amount of new capacity being built will be offset by the amount of LNG being mothballed. In reality, however, new construction plans for LNG far outpace mothballing. Additionally, the mention of “mid- to long-term shortfall in the amount of capacity of the main regulating power resource due to the closure of thermal power sources,” suggests a long-term commitment to using fossil fuels as a regulating power source.

However, the construction of new LNG power plants is counterproductive to avoiding climate change, and the construction of power plants and infrastructure and import of the fuel is extremely costly. Instead of continuing to give fossil fuels a starring role in Japan’s energy mix, we should consider transitioning our power system to one that places renewable energy at its core.

Table. Planned construction and retirement of power plants by the end of FY2032

Coal-fired power utilization rate expected to remain at about 70%

The figure below shows the capacity factor (facility utilization rates) by power source.

Coal power was projected to have a capacity factor of about 66% in last year’s forecast, but in fact it was only about 57% in FY2023. Over the next 10 years, it is expected to remain in the high 50% to low 60% range. The capacity factor of LNG power is currently declining, and according to plans, it will drop to 34% in FY2033.

In order to reduce the amount of electricity generated from “inefficient coal”* power, the government will try to use the capacity market system to reduce its capacity factor to 50% or less from FY2025.

(*Inefficient coal: coal-fired power generation using sub-critical (Sub-C) and super-critical (SC) power generation technologies)

Although the capacity factor has decreased somewhat from last year’s projection, the figure below shows that current plans expect the factor to remain high even 10 years from now.

Projected trends of capacity factor by power generation source

The capacity factor of nuclear power is projected to exceed 25% in FY2023, but is expected to gradually decline, falling below 20% by FY2033.

For storage batteries, the rate is expected to have increased significantly over the past year.

Conclusion

Deviating significantly from the global goal of tripling renewable energy agreed to at COP28, Japan’s government and energy companies are stubbornly coming up with excuses to maintain the country’s thermal power infrastructure, such as to “secure adjustability” of energy sources and “to promote hydrogen/ammonia co-firing with fossil fuels in order to create demand for hydrogen and ammonia”. However, we don’t have time to wait for technological development or supply chain construction as climate change continues to progress and become a bigger threat to the health of us and our society.

JBC sincerely hopes that, rather than ignoring the goals agreed upon by the international community, the government will send a firm signal to businesses to transition to renewable energy, and that energy companies will accordingly rethink their future plans based on a long-term energy outlook and the benefits brought by a just transition to renewable energy.