On March 30, 2023, the Organization for Cross-regional Coordination of Transmission Operators (OCCTO) released the Aggregation of Electricity Supply Plans for FY2023. This is a compilation of electricity supply plans submitted by 1,816 power suppliers, compiled by OCCTO.

The “supply plans” presented here are plans for the development of electricity supply, as well as the development of power sources and transmission lines, for the next 10 years (from FY2022 to FY2032) prepared by power suppliers. At 2022’s G7 Leaders’ Summit, it was agreed to “achieve predominantly decarbonised electricity sectors by 2035,” and Japan’s efforts to implement this agreement have been called into question. However, it has become clear that the percentage of coal in the power supply composition is expected to remain almost unchanged from the current level, and renewable energy is expected to increase only slightly, falling well short of Japan’s targets for the power supply composition in FY2030, even in FY2032.

Coal to account for 32% of Japan’s energy mix in FY2032

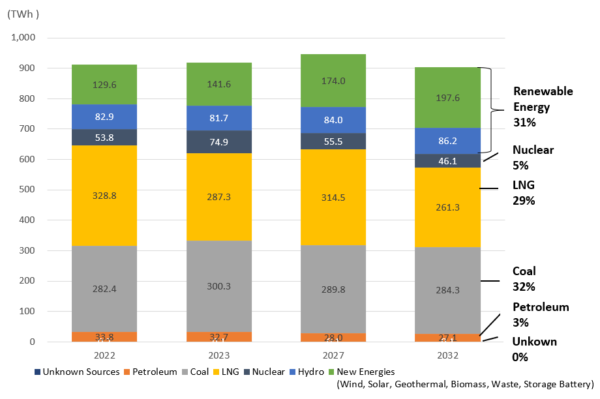

From the trends and forecasts of the aggregated transmission-end electricity supply shown in this Aggregation, Kiko Network has calculated the power supply composition for the FY2032, which is shown in the following graph.

According to last FY’s Aggregation, the percentage of coal in 2031 was 32%, and this year’s Aggregation shows no change for 2032 (32%). While many countries are moving away from fossil fuels such as coal, LNG, and oil, Japan’s power suppliers are planning to rely heavily on coal-fired power even 10 years from now.

In addition, while Japan’s 6th Strategic Energy Plan aims to achieve 36-38% renewable energy by 2030, it shows that even in 2032, the percentage of renewable energy (31%) has not yet reached the target in these power suppliers’ plans.

Projected Transition of Electric Energy Generation (net) by Power Generation Source

No decline in thermal power generation

The overall installed capacity is expected to increase over the next decade.

By power source, hydroelectric and nuclear will remain constant, but capacity of new energies other than hydroelectric is expected to increase by about 40 GW.

In thermal power, oil continues to decline, but even after 10 years, coal will remain constant and LNG will increase by about 2.9 GW. Despite the fact that about 3 GW of new coal-fired power plants were constructed in FY2022, the supply plans of the power suppliers do not show a trend of declining installed capacity, and no reduction plan has been presented for the power supply composition target in FY2030 (coal: about 19%).

Installed Capacity (National Total)

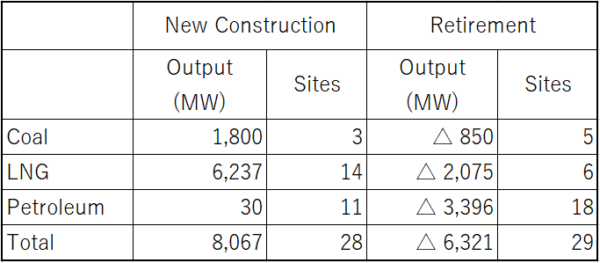

Power plant construction and retirement plans show no change in power suppliers’ coal dependency

In order to combat climate change, substantial reductions must be promoted toward the phase-out of existing coal-fired power plants by 2030. However, only five plants with a total capacity of 0.85 GW are planned to be phased out by FY2032.

While the number of new coal-fired power plants has decreased from 7 plants representing 4.82 GW in the last FY’s Aggregation, there are still plans to construct 3 new coal-fired power plants with a capacity of 1.8 GW. This is because 4 coal-fired power plants (3.02 GW) began operation in FY2022.

The remaining 3 plants under construction (1: Saijo and 2: Yokosuka), if construction continues smoothly, will begin operation in FY2023-24 (click here for information on residents opposing the construction of the Yokosuka coal-fired power plant).

Regardless of its efficiency, coal-fired power generation emits large amounts of CO2, and it must be phased out by 2030 in order for the world to avoid climate change’s worst impacts. Japan’s coal-dependent power supply composition is, in the words of UN Secretary-General Guterres, “on a highway to climate hell with our foot on the accelerator”.

In its opinion to the Ministry of Economy, Trade and Industry (METI), OCCTO cites the results of successful bids in the capacity market, stating that “while the number of LNG-fired power plants retired or suspended is increasing, the retirement and suspension of coal-fired power plants is not progressing”. It should be noted, however, that in reality, the number of new LNG-fired power plants planned to be constructed also exceeds the number of plants to be closed.

Planned construction and retirement of power plants by the end of FY2032

Coal-fired thermal power capacity factor remains at about 70%

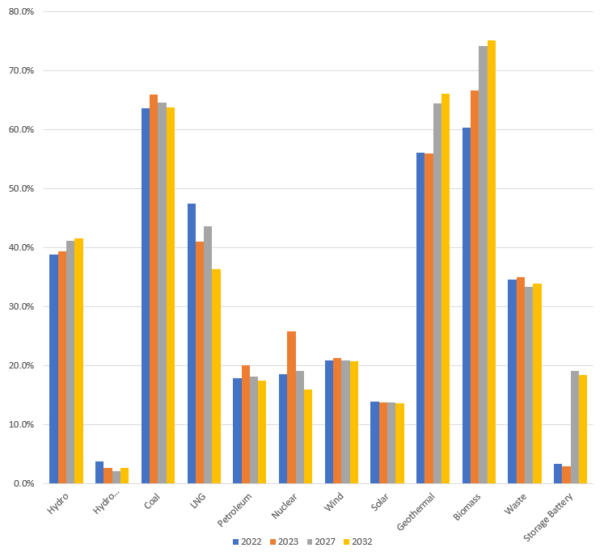

The following figure shows the capacity factor (facility utilization rates) by power source.

The trend for thermal power is similar to the Aggregation released in the previous FY. Coal is expected to remain almost unchanged at about 65%, and LNG is expected to see a decrease of about 10% in its capacity factor through FY2032.

In order to reduce the amount of electricity generated from “inefficient coal-fired power plants”, the government will induce the reduction of the capacity factor to below 50% from FY2025 through the capacity market system.

(Inefficient coal-fired power plants: Sub-Critical (Sub-C) and Supercritical (SC) coal-fired power generation)

However, the figure shows that, rather than proceeding with retirement of “inefficient coal-fired power plants”, the current plans are to continue to use them at a high utilization rate, even 10 years from now.

The government anticipates “fading out” of “inefficient coal-fired power plants” by 2030, but the plans submitted by the power suppliers show no clear path to this goal, and it is necessary to take a hard look at whether “fading out” can really be achieved.

Projected trends of capacity factor by power generation source

The utilization rate for nuclear power is expected to rise to more than 25% in FY2023 and then afterwards fall to below 20%.

The capacity factors for geothermal, biomass, and storage batteries are expected to grow by more than 10% over the next 10 years. Nevertheless, the figure clearly shows that coal and gas will still account for a high percentage of the total in 2032.

Conclusion

Under the banner of “decarbonizing thermal power,” METI is currently supporting the development of systems and supply chains for hydrogen/ammonia co-firing and CCS, which are still in the demonstration stage, and is pushing forward in the direction of maintaining thermal power.

However, what really needs to be supported are the already established and low-cost technologies, such as energy conservation, demand response (DR) and other demand-side measures, renewable energy, and increased grid flexibility to utilize variable renewable energy.

Globally, the shift to renewable energy is increasingly underway.

In order to commit to the goal of a predominantly decarbonized power sector by 2035 agreed to by the G7 in 2022, governments should send clear signals to power suppliers to transition to renewable energy rather than maintain use of thermal power, and develop and support policies for this transition.

Reference:

・Aggregation of Electricity Supply Plans for FY2023 (March, 2023)(only Japanese is available as of April 2023)

・(Last FY’s article) Japan Beyond Coal ”【News】 OCCTO released the Aggregation of Electricity Supply Plan 2022 – Coal to account for 32% in FY2031”