JERA is the biggest power utility in Japan, operating 26 thermal power plants responsible for approximately 30% of the country’s power capacity.

On January 26, the Institute for Energy Economics and Financial Analysis (IEEFA) published a special article titled “JERA is putting Japan’s decarbonization goals at risk”. The content of the article is summarized below:

- JERA’s pursuit of co-firing ammonia and hydrogen in its thermal-generating assets will preserve its existing fossil fuel business at the expense of implementing the emission reductions required to put the company and Japan on a credible net-zero pathway.

- With Japanese electricity demand in long-term decline at the same time that domestic nuclear power plants are being restarted, JERA is turning increasing attention to overseas markets. JERA aims to replicate its energy strategy across Asia and are offering false hope that Japan’s surplus liquefied natural gas (LNG) and both ammonia and hydrogen ammonia could decarbonize the power sectors across the region.

- Recentering JERA’s roadmap around an acceleration of renewables will help Japan and other Asian countries achieve their climate commitments, improve energy security across the region by reducing import dependence, and insulate JERA from the vulnerabilities of fossil fuels.

The IEEFA points out that JERA shows no signs of abandoning its fossil fuel-dominated business model as it seeks to prolong the life of its coal-fired power plants through adopting unproven decarbonization technologies. Without a change in corporate strategy geared toward a more aggressive deployment of proven, cost-effective renewables, JERA’s approach could derail not only Japan’s decarbonization goals, but also Asia’s shift to net zero.

Would JERA’s strategy even work?!

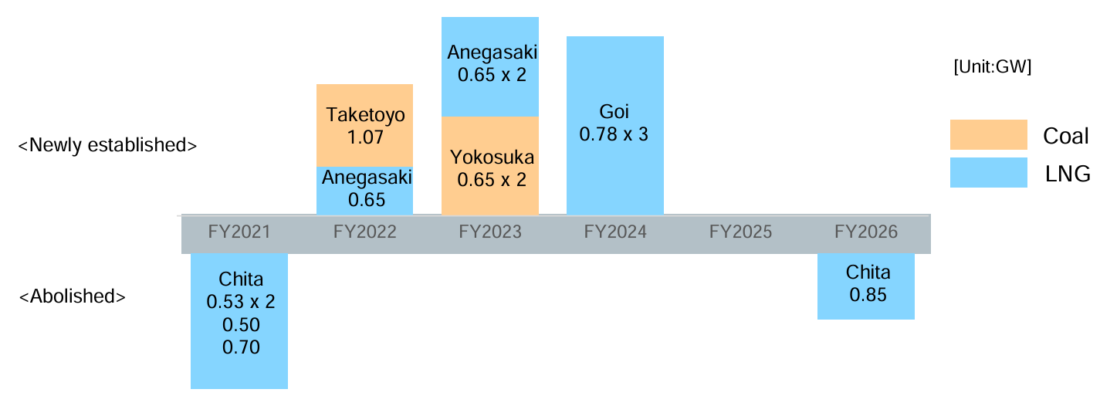

JERA’s decarbonization roadmap for power generation indicates a plan to “decommission all of JERA’s inefficient coal power plants (super critical or less)”. However, JERA is planning to pursue the costly and less effective strategies of co-firing ammonia or hydrogen in the remaining power plants. Without making any specific plans for stopping or shutting down any power plants by 2030, JERA has begun operating new large thermal power plants, including the Yokosuka Thermal Power Station, as shown in the figure below.

JERA has announced that it will start large-scale ammonia co-firing (20% calorific value ratio) at Hekinan Power Station (Hekinan City, Aichi Prefecture) Unit 4 in FY 2023. JERA’s roadmap shows a plan for commercial operation of 20% ammonia co-firing by the late 2020s, 50% co-firing by the early 2030s, and 100% by 2050. Regarding hydrogen co-firing, JERA calls for a demonstration experiment of 30% co-firing by FY2025 and commercial operation in the mid-2030s. However, none of these plans are consistent with a coal phase-out by 2030, which is required by developed countries in order to meet the goals of the Paris Agreement and prevent the worst impacts of climate change.

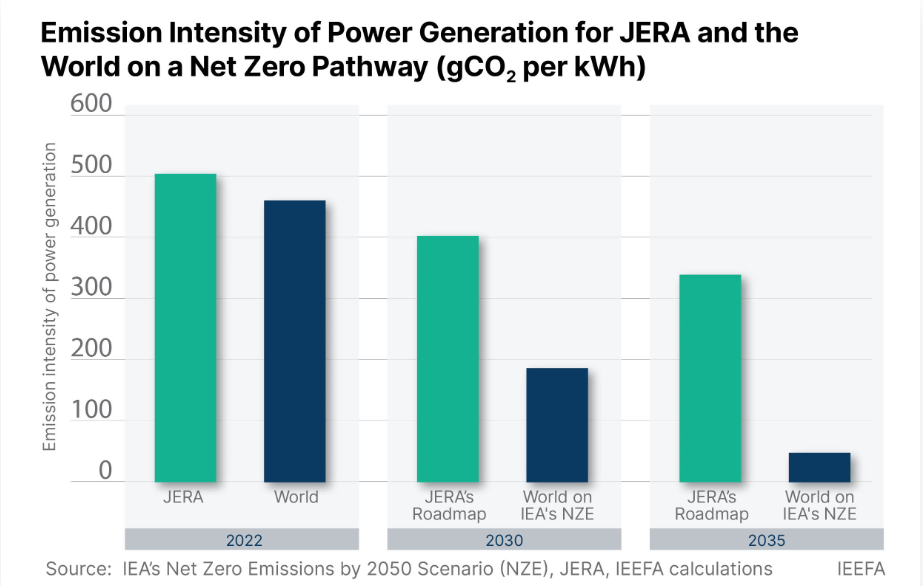

According to calculations by the IEEFA, JERA’s roadmap would reduce the amount of carbon dioxide the company generates per unit of thermal power by one third by 2035 – progress, but far short of the net-zero path championed by the International Energy Agency (IEA).

Since JERA’s power generation is equivalent to 30% of Japan’s thermal generation capacity, the IEEFA is concerned that JERA’s strategy will hinder the decarbonization of Japan’s power sector and delay the emission reductions that Japan needs to achieve. Promoting utilization of hydrogen and ammonia is also not economically rational, as it is likely to have a much higher cost than renewable energy. Furthermore, Japan would be dependent on imports of hydrogen and ammonia, whether gray, blue or green, leaving its dependence on imported fuels intact and hampering the country’s energy security.

IEEFA’s article explains why JERA is pursuing this strategy:

- The most profitable part of JERA’s business has typically been its domestic thermal power segment, so the company is trying to extend the life of domestic thermal power plants by co-firing hydrogen and ammonia.

- JERA is a fossil fuel company by design, established in 2015 to consolidate the thermal generating assets and the fuel supply chains. The company’s fuel trading segment, JERA Global Markets, handles 12% of the global LNG market, providing it with considerable bargaining power to negotiate favorable contracting conditions.

- JERA’s overseas investments across the fossil fuel value chain complement and mitigate risks for its domestic operations. JERA can optimize energy trading and shipping across its portfolio, offsetting higher input costs by trading gains.

The article concludes that recentering JERA’s decarbonization roadmap around an accelerated deployment of renewables, not extending the lifetime of thermal power plants, would help Japan and other Asian countries to meet their climate commitments, improve energy security, and reduce exposure to volatile fossil fuel markets.

Article link:

JERA is putting Japan’s decarbonization goals at risk (Link)