German environmental NGO Urgewald has updated two databases on companies involved in the fossil fuel business: the Global Coal Exit List (GCEL) in October 2023, and the Global Oil & Gas Exit List (GOGEL) in November 2023. These lists are updated annually and referenced by institutional investors as the world’s most comprehensive public database on fossil fuel-related businesses.

2023 Global Coal Exit List (GCEL)

- 40% of companies on the GCEL are developing new coal assets

- 95% of the industry still lacks a coal phase-out commitment

The 2023 Global Coal Exit List (GCEL), released by Urgewald and more than 40 NGO partners, provides in-depth information on over 1,400 companies operating along the thermal coal value chain. It identified out of the 1,433 companies on the 2023 GCEL, only 71 companies have announced coal exit dates, and 577 companies are still developing new coal assets.

Still Expanding Coal Assets

Despite coal plant closures in some parts of the world, the global coal plant fleet has seen a net growth of 186 GW since the Paris Agreement was signed. Although plans for new coal-fired power plants have declined significantly, companies are still planning to develop an additional 516 GW of new coal-fired capacity. If all those plants are built, it is estimated that those projects would increase the world’s installed coal-fired capacity by 25%. Two-thirds of this new capacity is planned in China. Out of the 39 countries where new coal power plants are still in the pipeline (excluding China), the largest capacity additions are planned in India (72 GW), Indonesia (21 GW), Vietnam (14 GW), Russia (12 GW) and Bangladesh (10 GW).

The GCEL points out that not only coal-fired power generation, but also coal mining have been expanding; the world’s thermal coal production reached an all-time high in 2022 at over 7.2 billion tons. The companies listed on the GCEL are planning to develop new thermal coal mining with a total capacity of 2.5 billion tons per year, an amount equal to over 35% of the world’s current production.

Even though the United Nations, International Energy Agency, and climate scientists all over the world have repeatedly called for accelerating an exit from coal, many coal-related companies are still continuing to operate their coal business as usual. Out of 1,433 companies listed on the GCEL, only 71 companies – 5% of the total – have put an end date on their coal business lines. And among these 71 companies, many have set phase-out dates that are far too late; only 41 companies have adopted coal exit dates that could be considered Paris-aligned. Another issue is that even if companies announce an exit date, it does not mean they are soundly promoting decarbonization, as many companies are planning to replace their coal-fired capacity with fossil gas. It is clear that replacing one fossil fuel with another is not the answer for decarbonization. According to Urgewald, only a handful of companies on the GCEL have committed to a timely closure of their coal assets and to replacing coal-fired generation with renewable energy.

Japan proudly promotes its GX strategy, policies that won’t lead to decarbonization

Japanese coal-fired power generation companies listed on GCEL (Installed capacity of 1,000 MW or more)

In Japan, Yokosuka Power Station Units 1 and 2 began commercial operation in June and December 2023 respectively, and Kobe Power Station Unit 4 started operation in February 2023. In addition, the environmental impact assessment (EIA) for GENESIS Matsushima (Matsushima Power Station) is in progress to prepare for starting operation in FY2028. Companies are aiming to achieve “zero-emission” thermal power generation by 2050 while investing a large amount of money in developing technologies for ammonia and hydrogen co-firing with coal, but hydrogen/ammonia co-firing is expensive and ineffective in reducing emissions. Even if CO2 is not emitted during combustion, as long as the supply of green hydrogen/ammonia continues to be not foreseeable, Japan cannot achieve a coal exit by 2030 or achieve the Paris Agreement’s 1.5°C target if gray ammonia/hydrogen, which emit large amounts of CO2 in the production process, are co-fired with coal. Under the GX strategy set by the Japanese government, various companies, including power companies, gas companies and trading houses are actively moving to expand the use of hydrogen/ammonia and develop supply chains.

The GCEL is used as a reference for making decisions on investment by financial institutions and institutional investors throughout the world. Japan’s major power companies listed in the GCEL will be subject to divestment if they do not make progress in their decarbonization efforts. While investments and loans are under review, many companies are still operating their coal-related business with the support of financial institutions and continue to bypass regulations. Urgewald stresses that it is necessary to stop investment in companies that are propelling us towards a breakdown of our planet’s climate system.

2023 Global Oil & Gas Exit List

- 96% of upstream companies still exploring or developing new oil and gas fields

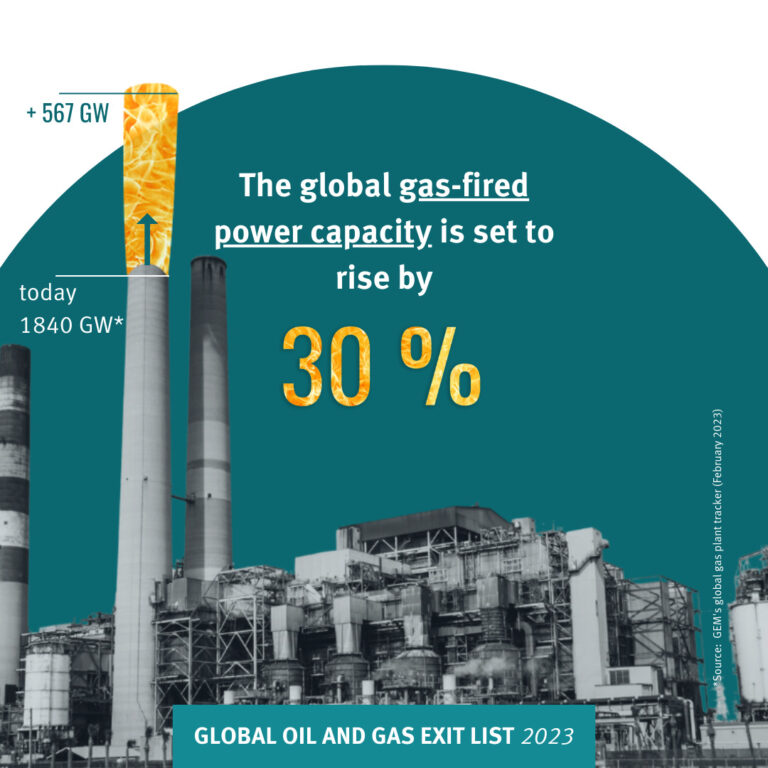

- Global gas-fired power capacity set to rise by 30%

- Industry plans 162% increase in LNG export capacity

The Global Oil & Gas Exit List (GOGEL), published by Urgewald with more than 50 partners, is a public database that provides a detailed breakdown of the activities of oil and gas companies worldwide. This second update covers 1,623 companies active in the upstream, midstream and gas-fired power sector. These companies account for 95% of global oil and gas production.

Expanding new oil & gas project development

In the midst of the climate crisis, 96% of the 700 upstream companies on GOGEL are still exploring or developing new oil and gas fields. 1,023 companies are planning new LNG terminals, pipelines or gas-fired power plants. According to the International Energy Agency’s (IEA) roadmap to net zero by 2050, published in 2021, there is no need for new oil and gas exploration. However, since 2021, the industry’s annual capital expenditure on oil and gas exploration has risen by more than 30%. Over the past 3 years, oil and gas companies listed on GOGEL spent a total of US$ 170.4 billion on exploring for new oil and gas reserves that cannot be burned. 539 companies are preparing to bring 230 billion barrels of oil equivalent (bboe) of untapped oil and gas resources into production.

Companies listed on the GOGEL are planning to increase global LNG export capacity by 162%. New LNG export terminals are key drivers of large-scale gas extraction in countries like the US, Qatar, or Mozambique.

GOGEL also identifies 651 companies that are planning to develop an additional 567 gigawatts (GW) of gas-fired power plants. If these are built and start operation, they would increase the world’s installed gas-fired capacity by 30%. The IEA’s projections show that in a 1.5 °C-aligned world, the contribution of unabated natural gas to the energy mix must fall from today’s 22% to 6% by 2035. Instead of building new gas plants, this would require the retirement of 82 GW of installed gas-fired capacity by 2035. There is no room for new gas plants.

Consistency with 1.5°C roadmap

The GOGEL calculates the percent in which a company’s short-term expansion (STE) is overshooting the IEA’s roadmap, as an assessment of whether a company’s activities are in line with IEA’s net-zero (NZE) 2050 scenario (2021/2022). This is an indication of the degree of risk to which the asset is exposed to.

Urgewald states that the oil and gas industry’s climate action amounts to little more than a competition in dodging accountability, making empty promises and spreading misinformation.

Japanese companies involved in the oil and gas business

There are no coal mines or oil and gas fields in Japan. However, many Japanese companies are involved in the development of gas fields and the construction of fossil fuel infrastructure such as pipelines and related facilities outside of Japan in order to transport fossil fuels to Japan. Additionally, construction of gas-fired power plants is underway both in Japan and abroad. As of 2023, there are four gas-fired power plant projects under environmental impact assessment in Japan.

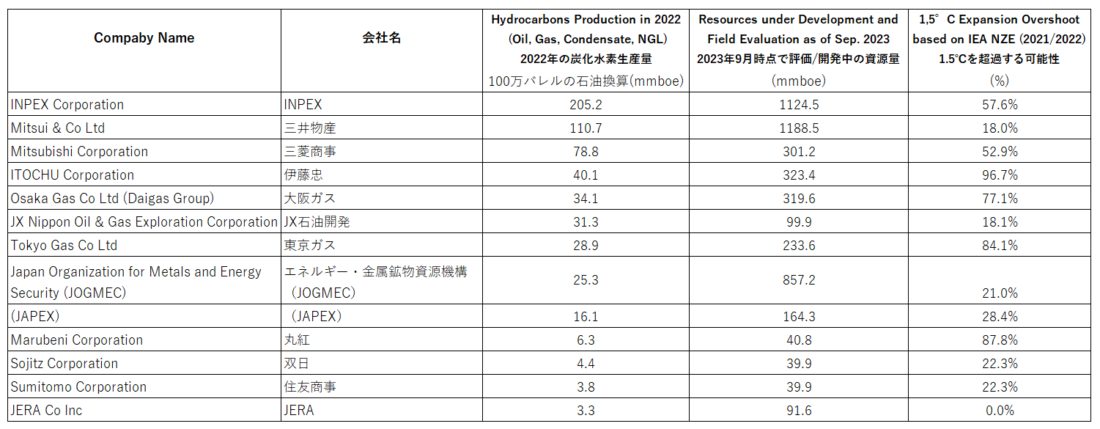

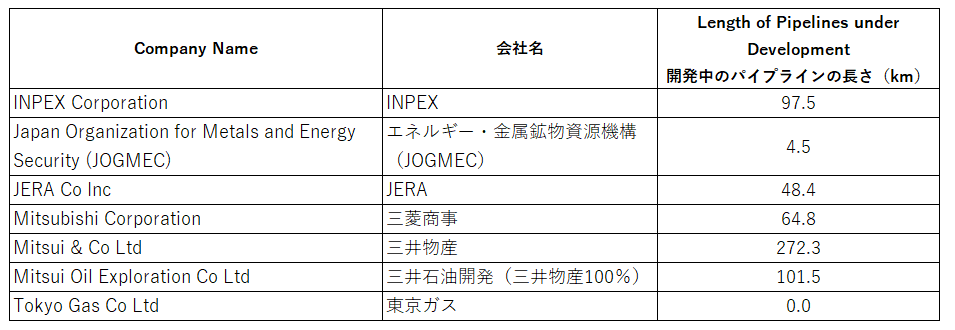

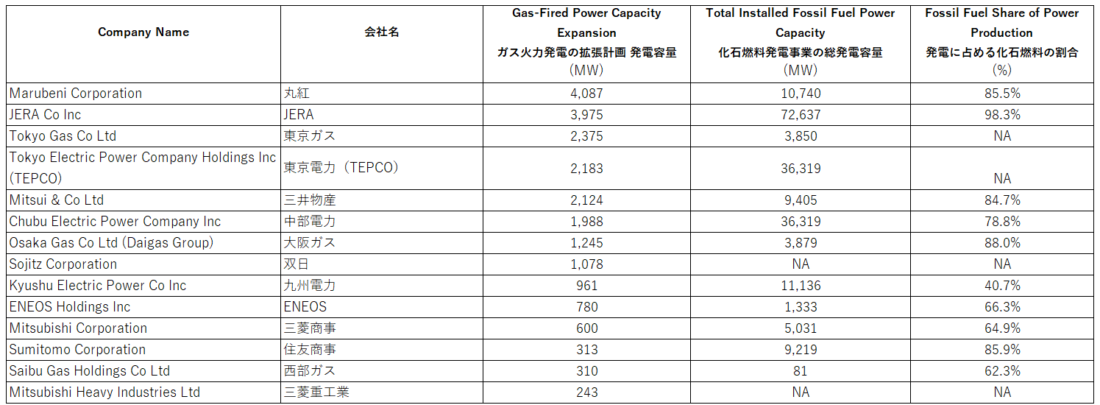

The Japanese companies listed on the GOGEL and their scale of business are listed below:

Japanese companies involved in upstream operations

Japanese companies involved in mid stream operations

Japanese companies involved in gas-fired power generation

Related Links

Urgewald’s Media Briefing

The 2023 Global Coal Exit List: Failing the Phase-Out(Link)