On April 10, 2025, Asian energy research and consultancy group Asia Research & Engagement (ARE), published Japan’s Ammonia Strategy: Excessive costs signal need for alternatives in the power sector, a model-based economic analysis of Japan’s plans to co-fire ammonia with coal as a strategy to decarbonize its power sector. The results of the study indicate that co-firing coal with blue ammonia would lead to substantial financial burdens and require massive government subsidies to support.

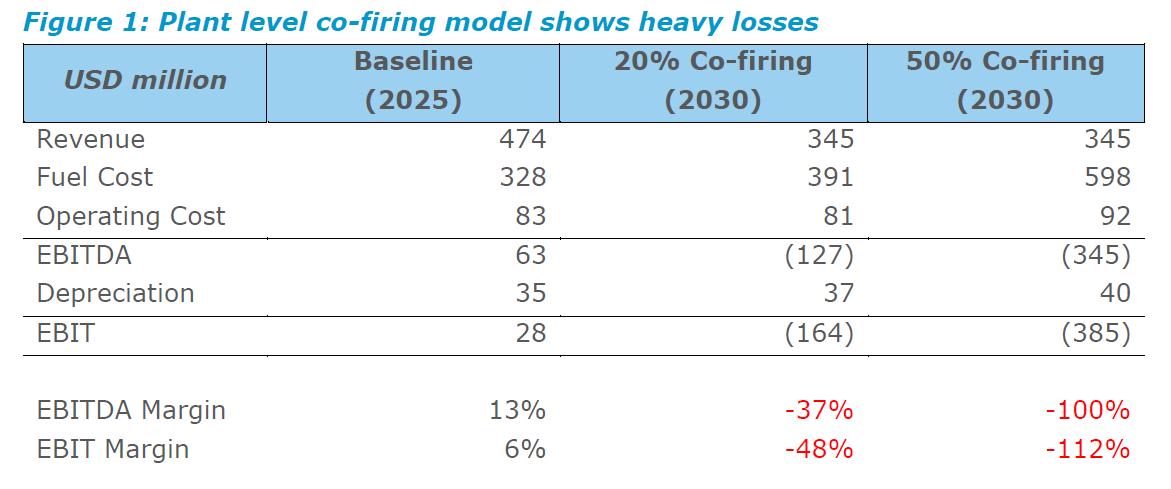

Three coal-fired power scenarios are examined in the analysis: a Baseline model of current coal-fired power plant operating conditions using a hypothetical, highly efficient Ultra-Supercritical (USC) coal-fired power plant; a scenario with 20% blue ammonia* co-firing; and a scenario with 50% blue ammonia co-firing.

The key findings of the report are as follows:

- Analysis of coal operators’ financial fundamentals reveals that under current market conditions, coal plants are operating with slim margins. Co-firing with blue ammonia will impose a significant financial burden. At a co-firing rate of 20% ammonia, production costs are 1.5 times revenues; at 50% co-firing, those costs are more than double revenues.

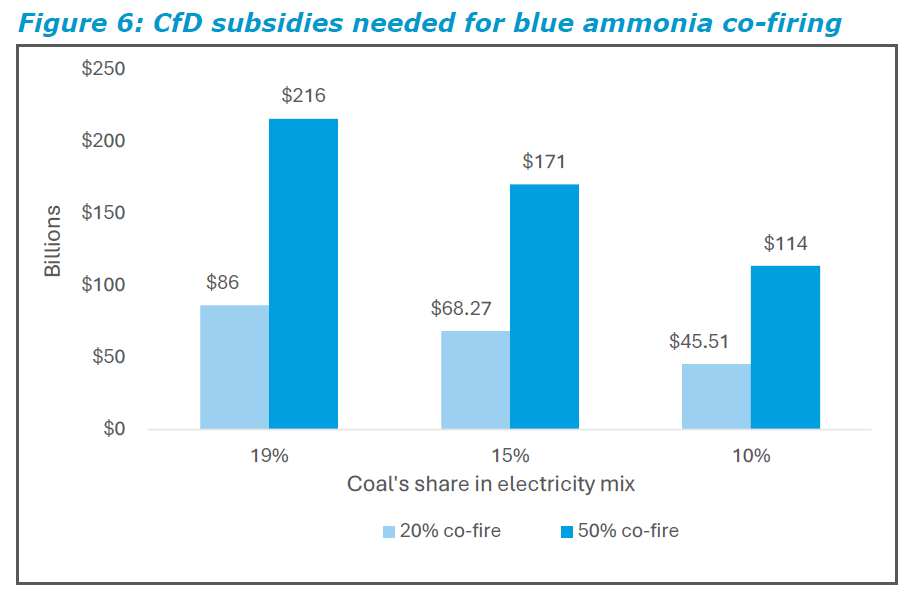

- Support for blue ammonia co-firing would entail considerable cost. Assuming a blue ammonia co-firing rate of 50% and a 10-19% share of coal power in Japan’s future electricity mix, it is estimated that 15-30 trillion yen (USD $100-200 billion) of fuel subsidies will be needed over a 15-year period.

- According to the analysis, the subsidies needed to support coal power generation alone would be 5-10 times greater than the 3 trillion yen (USD $20 billion) currently allocated to support hydrogen and ammonia in power generation and other hard-to-decarbonise industries in Japan.

*Blue ammonia is ammonia produced from natural gas and using carbon capture and storage (CCS) technology. Green ammonia (ammonia produced from renewable energy sources) was not included in this study due to uncertainty over its future costs.

The report points out the many uncertainties regarding the technological and economic feasibility of Japan’s ammonia co-firing plans, noting that there has only been one large-scale demonstration test so far (Hekinan Power Station in 2024), and that the absence of industrial-scale blue ammonia production presents a significant challenge to supply-chain development, as high production costs deter buyers from committing to offtake agreements, which further delays projects.

Significant costs of ammonia

According to the study, current coal-fired power plants are operating with minimal margins, leaving little room for profitability under current market conditions. However, costs skyrocket with the introduction of ammonia co-firing, as blue ammonia prices have a considerable impact on the profitability of co-firing. Fuel expenses greatly surpass revenues at both 20% and 50% co-firing levels, leading to deeply negative operating results. For 20% co-firing, production costs are 1.5-times higher than revenue, and production costs rise to more than double revenues when co-firing at 50%. It is noted that there is little evidence to suggest that ammonia prices will decline sufficiently to reach price parity with coal, even over the next 20 years, and that it is unlikely that governments will continue subsidising the ammonia cost premium indefinitely.

*1 EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization

*2 EBIT: Earnings Before Interest and Taxes

Financial burden of co-firing subsidies

In order for Japan to maintain and simultaneously decarbonise coal power’s presence in the country’s energy mix, substantial financial support will be required, such as the government’s 3 trillion yen (USD $20 billion) subsidies to compensate for the price gap between low-carbon hydrogen or ammonia and fossil fuels for 15 years. However, according to the models in this study, a power plant utilizing 20% co-firing requires a subsidy of 4,350 yen (USD $29) per MWh, or 27% of total fuel and operating expenses. At 50% co-firing, the subsidy increases to 10,950 yen (USD $73) per MWh, accounting for 47% of fuel and operating expenses.

Even considering Japan’s Ministry of Economy, Trade & Industry’s (METI) expected reductions in coal’s share of the electricity mix over the next two decades, the total price gap compensation subsidies required would range from 6.75 trillion yen (USD $45 billion) to 32.4 trillion yen (USD $216 billion) depending on the level of co-firing and coal plants’ contribution to the electricity mix. This is far greater than the 3 trillion yen (USD $20 billion) so far allocated, which covers all hard-to decarbonise industries in Japan.

Expansion of renewables is making electricity cheaper

The report also analyzes Japan Electric Power Exchange (JEPX) pricing data over the past five years, showing that the gap between peak and trough prices doubled between 2018 and 2023. As solar capacity grew from 50GW in 2017 to 90GW in 2023, prices during the middle of the day have steadily dropped, when solar power is abundant. However, rates from late afternoon onwards have risen, when thermal power supply takes over.

If battery storage capacity grows almost five-fold by 2033, as outlined in Japan’s electric power companies’ projections, renewable power generation could potentially be used in the evening, which will lead to the flattening of the daily price curve. Consequently, peak electricity pricing periods available to thermal power plant operators will decline. At the same time, the continued expansion and integration of renewable energy into the grid is expected to drive average electricity prices lower. The analysis concludes that these trends combined are likely to further erode the economic viability of coal power and render the expense of deploying ammonia co-firing technologies even more prohibitive.

In the context of the substantial costs associated with ammonia co-firing and the increasing economic competitiveness of renewable energy, the final conclusions of the study present a clear recommendation: instead of extending the life of coal-fired power by pursuing ammonia co-firing as a decarbonization measure, “the logical course of action is to redirect resources toward scaling alternative electricity sources, strengthening the grid, investing in battery storage, and accelerating the reduction of coal’s share in the electricity mix.”

Report Download

【Asia Research & Engagement】Japan’s Ammonia Strategy: Excessive costs signal need for alternatives in the power sector (Link)

Related Articles

【News】 Government to make up price difference between hydrogen/ammonia and fossil fuels (Link)

【Report】”Japan’s Costly Ammonia Coal Co-Firing Strategy”: BloombergNEF Analysis Report (Link)

Written/published by: Asia Research & Engagement

Published: April 10, 2025