Is this acceptable? – Coal power in Japan

Major countries are

transitioning away from coal.

What about Japan, the world’s fifth largest CO2 emitter?

\More details:/

- Dangers of continued coal reliance

- Japan’s coal reliance bucks global trend

- Japan’s “capacity market” perpetuates fossil fuels and nuclear

Dangers of continued coal reliance

The risks of clinging to unsustainable coal power

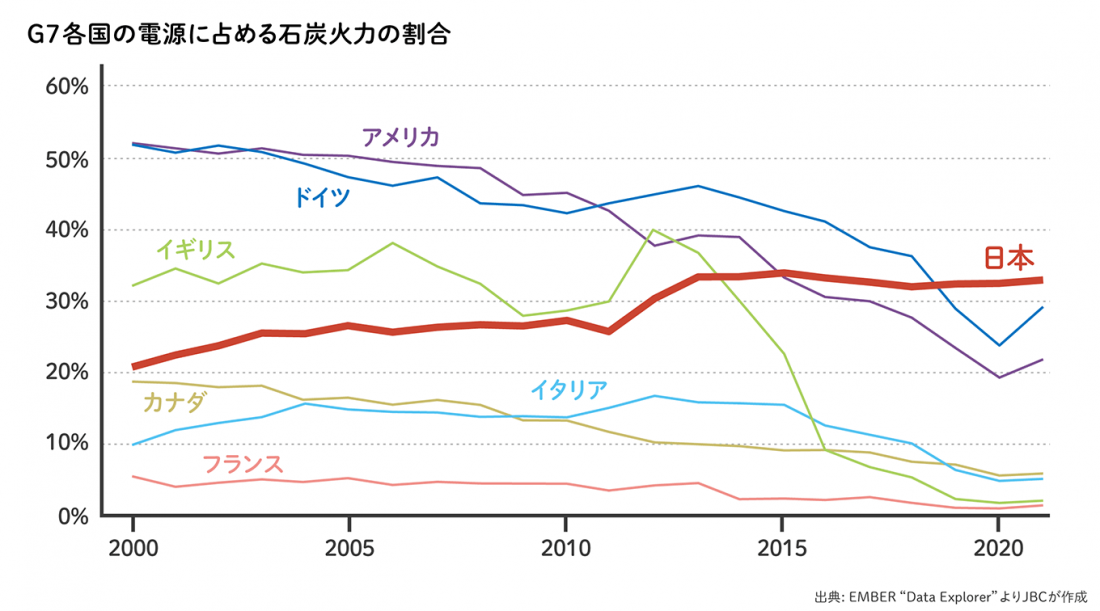

The world is moving rapidly to phase out coal power, a major source of CO2 emissions. The United States, a major coal user, is part of that trend. What about Japan?

Coal-fired power generation is holding steady in the range of 32.7% of Japan’s energy mix (2021 figures). In contrast, other countries have been steadily reducing coal’s share (although it rose temporarily after the invasion of Ukraine).

Japan is bucking this trend, with over 170 coal power generation units in operation, with two more plants under planning or construction (as of Sept. 2023).

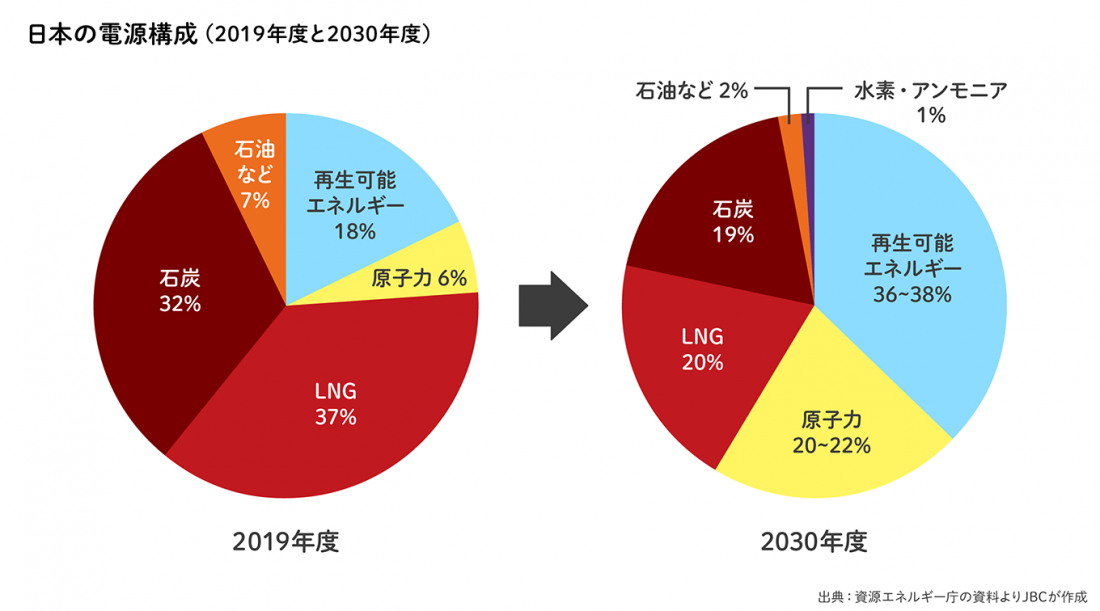

In fact, under the national Strategic Energy Plan updated by the government in 2021, coal-fired power generation will still account for 19% of the power mix in fiscal 2030. In contrast to other G7 countries, Japan’s plans offer no sign of reducing coal power to zero in the future.

Photo: Kiko Network

Why can’t Japan end its use of coal? The reason is that major power utilities want to continue using their existing facilities. They are trying to achieve “decarbonization” through what they refer to as “technological innovation,” using ammonia or hydrogen co-firing and carbon capture and storage. But will these new technologies ever achieve commercial application? There’s no guarantee. And even if they do, it would only be after many more years and end up simply extending the use of coal power. In contrast, renewable energy technologies are already well-established and further cost reductions are expected. So they have huge potential. The world needs immediate action to limit the global temperature rise, so now is the time to make a big shift to renewables!

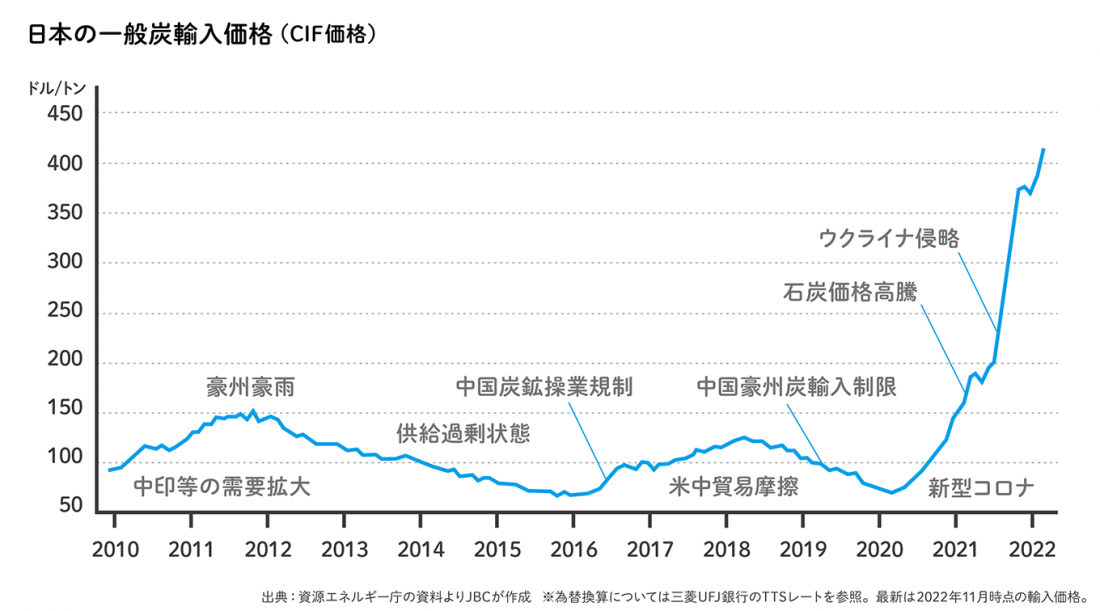

Thermal (fossil fuel) power generation today means high cost and energy insecurity

Thermal power generation comes with big problems: high cost and energy insecurity. Increased energy demand due to the post-pandemic economic recovery and Russia’s invasion of Ukraine have disrupted global supplies of fossil fuels, which account for about 80% of Japan’s total energy demand. Japan imports most of its fuel, so the cost of power generation has risen in tandem with rising prices of imported coal, oil, and natural gas. Electricity costs have skyrocketed for everyone, including households, offices, and factories.

As long as we depend on imported fuel for our energy supply, we must not forget that geopolitical tensions elsewhere in the world or a deterioration of relations with our energy suppliers could disrupt fossil fuel imports and have real impacts on our daily lives.

A continued dependency on coal to generate electricity exposes Japan to two major risks — the climate crisis and an unstable supply of energy.

Japan’s coal reliance bucks global trend

In Japan’s Sixth Strategic Energy Plan the government indicates the electrical power mix in 2030 will consist of 36-38% renewables, 20-22% nuclear, 20% LNG, 19% coal, about 2% oil, and about 1% hydrogen and ammonia.

Government and electric utilities which are attempting to continue using existing power generation facilities have allocated huge budgets to “innovation” to extend the life of fossil fuels. Under “Green Transformation” (GX) brand, they are trying to attract private investment by having public funds allocated to develop ammonia and hydrogen co-firing with coal, as well as carbon capture and storage and other technologies.

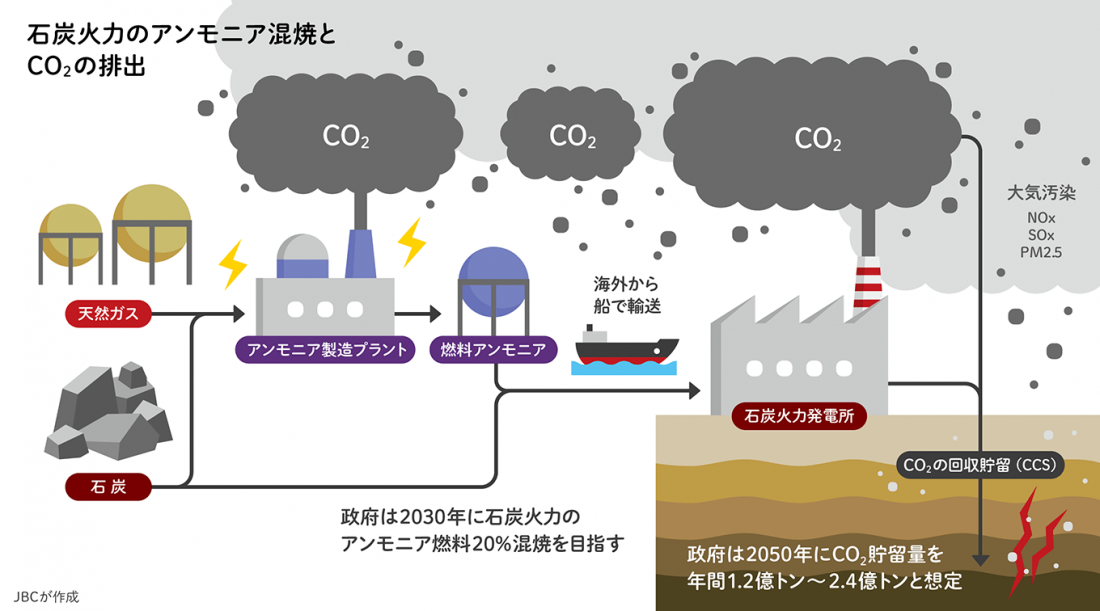

What’s wrong with fuel ammonia?

While hydrogen and ammonia do not emit CO2 during combustion, they cause significant CO2 emissions during production (from fossil fuels) overseas and marine transport. This means they are unlikely to reduce life-cycle emissions. The government has set the goal of a 20% ammonia mix co-fired with coal by 2030, but there is currently no serious prospect for large-scale commercial use of ammonia to generate electricity.

Health impacts are another concern with the use of fuel ammonia. The Centre for Research on Energy and Clean Air (CREA), an independent research institute that studies the effects of air pollution, reported that ammonia co-firing can increase PM2.5 emissions and lead to increased health risks from air pollution.

Aware of such issues, G7 and other countries are raising concerns about Japan’s power sector decarbonization strategy, emphasizing the need to be coal-free by 2030 and that the use of hydrogen and ammonia in the power sector should be limited.

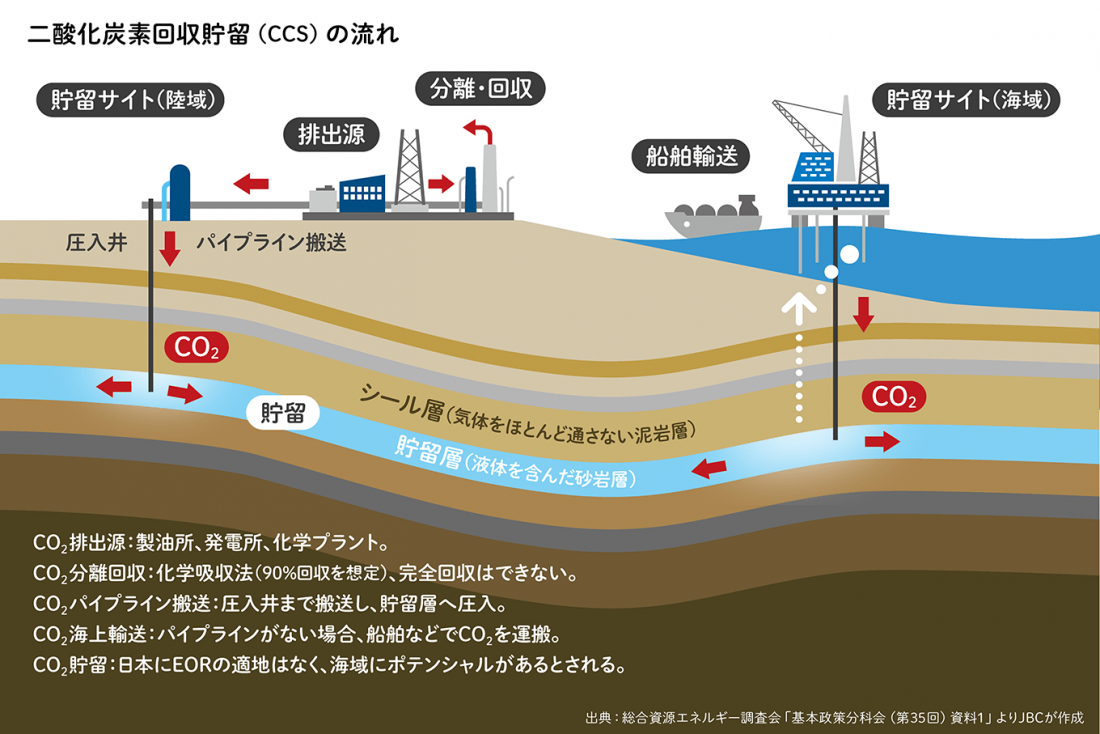

Problems with CCS and CCUS

Now let’s look at “carbon capture and storage” (CCS) and “carbon capture and utilization” (CCU) techologies being promoted to deal with carbon emissions from coal-fired power plants. Each process comes with many unresolved problems. Trials in various countries show that these technologies cannot be relied on as a climate solution.

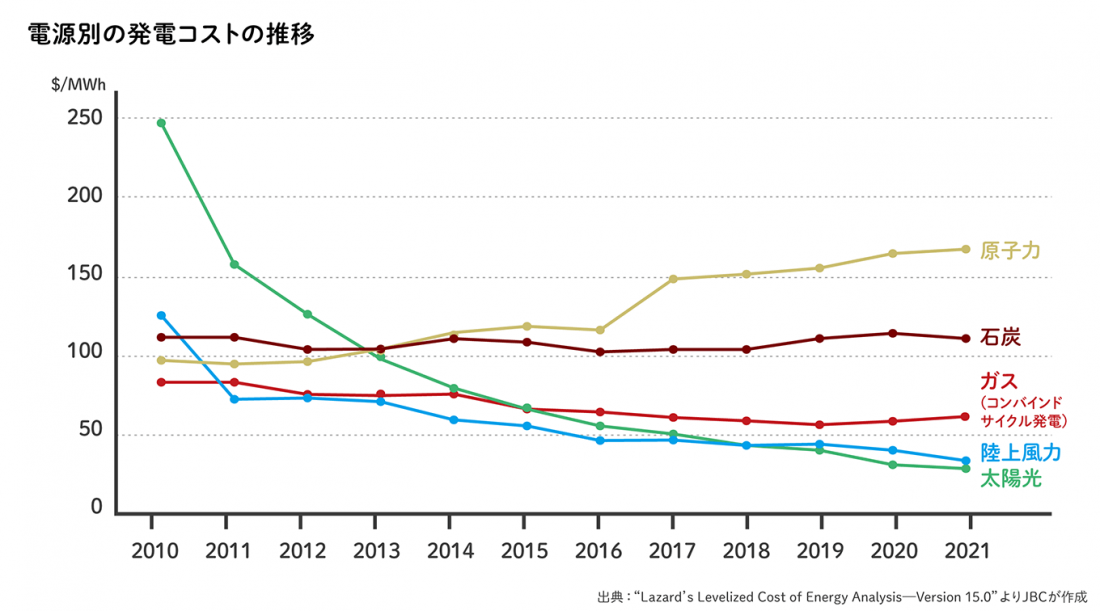

CCS and CCU technologies are prohibitively expensive and should not be used to sustain the continued operation of power plants burning fossil fuels. As decarbonization initiatives gain momentum the cost of renewables is falling. This contrasts with coal power generation, which is expected to see rising costs due to fuel price fluctuations and the anticipated introduction of carbon pricing. Coal power infrastructure could become a stranded asset as it becomes even less competitive in electricity markets!

Embrace renewables to help the economy!

Renewables are already the lowest-cost source of energy for electricity generation. Fossil fuels are already more expensive. Renewables do not burn fuel to generate electricity, so they are becoming even more cost competitive. The sooner we transition away from fossil fuels, the sooner we can reduce their burden on society and the economy.

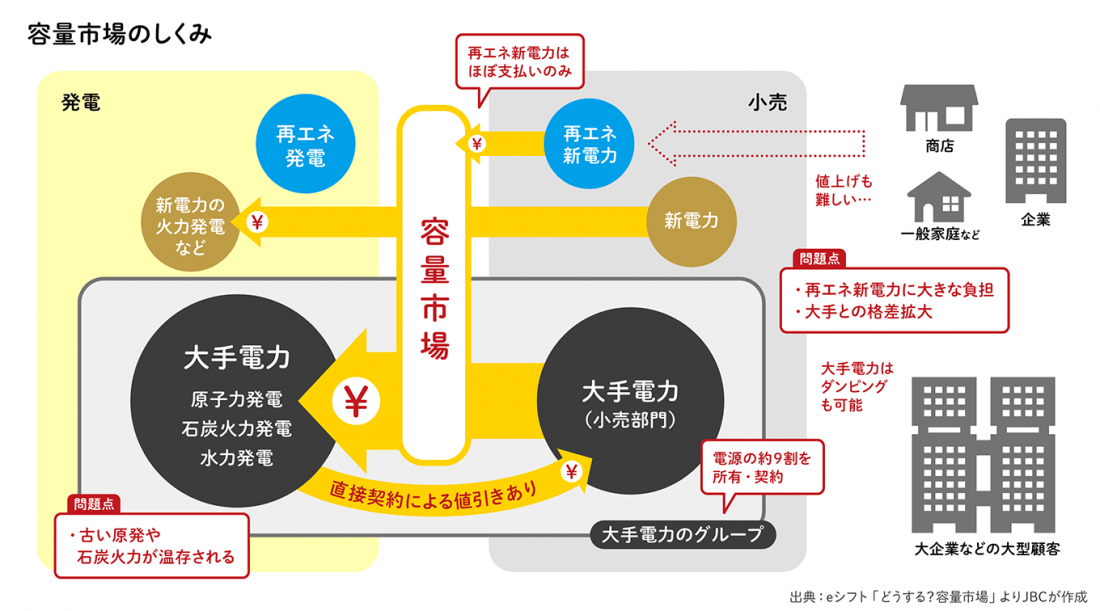

Japan’s “capacity market” perpetuates fossil fuels and nuclear

Japan introduced a “capacity market” in 2020 , responding to the purported need to maintain nuclear and thermal power plants even as the government insists it will realize a policy of making renewable energy the country’s main power source. Auctions are conducted to secure electricity supply capacity four years ahead, based on projected electricity demand. Auctions began in 2020 and payments to power plants are to begin in 2024. Utilities that own older coal power plants participated in the auctions and some of them won the bidding. The subsidy prices per kilowatt are 14,137 yen for 2024, 3,495 yen to 5,242 yen for 2025, and 5,833 yen to 8,748 yen for 2026. In other words, according to calculations from the subsidy prices, a coal-fired power plant with a capacity of one million kW (1 GW) would be paid about 14.1 billion yen in 2024.

This auction system makes it more profitable for power utilities to keep coal-fired power plants in service as long as possible rather than shutting dowm.

In fact, solar and wind power are not covered by this program. It actually puts the brakes on the energy transition to renewables.

It would be impossible for nuclear- and fossil fuel-powered plants to continue operating without government subsidies and policy support. Those costs are paid by the people through taxes, electricity prices, etc. A coal power phase-out in Japan will be impossible until these systems are overhauled significantly.