On March 31, 2021, the Organization for Cross-regional Coordination of Transmission Operators (OCCTO) released the Aggregation of Electricity Supply Plans for FY2021 (the Aggregation). Japan’s current Strategic Energy Plan identifies coal-fired and nuclear power plants as “important base-load power sources,” and, based on the plan, the Long-term Energy Supply-Demand Outlook designates the power supply composition (energy mix) as 20-22% nuclear, 22-24% renewables, 27% LNG, 26% coal, and 3% petroleum. This year’s power supply plan is the first time that power suppliers have presented their outlook on the supply side of achieving this energy mix in 2030. The contents of the Aggregation are explained below.

Coal will account for 34% of the power supply in FY2030

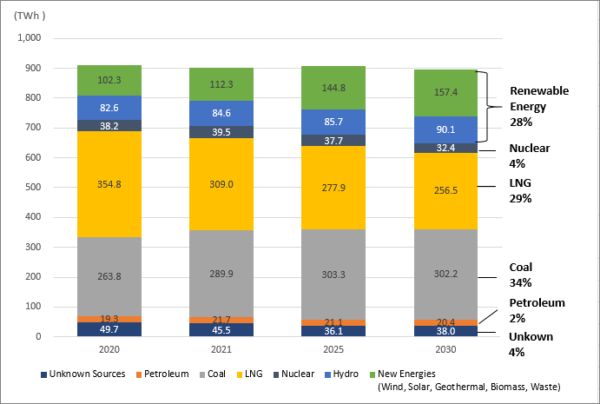

According to the Aggregation, the power supply composition of FY2030 is 28% renewables (18% new energy [wind, solar, geothermal, biomass, waste] + 10% hydro), 4% nuclear, 29% LNG, 34% coal, and 2% petroleum. Based on the Aggregation, the share of electricity generated from coal-fired power plants in FY2030 will increase by about 5% compared to FY2020, with coal accounting for the largest share as it did in the previous FY’s Aggregation (37% in FY2029, in the Aggregation of Electricity Supply Plan for FY2020).

Projected Transition of Electric Energy Generation (net) by Power Generation Source

Coal to account for all increases in the installed capacity of thermal power plants

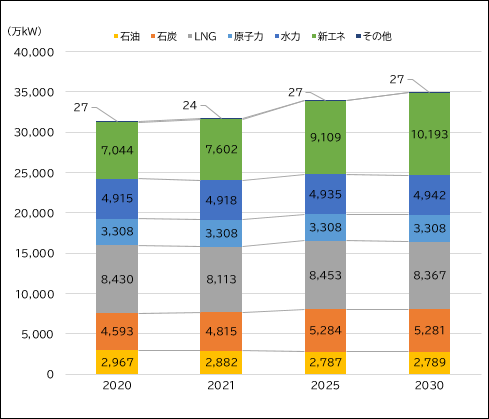

An overall positive trend can be seen regarding the installed capacity of power plants, and although installed capacity of hydro and nuclear power is expected to remain constant, thermal power is expected to increase by about 4.5 GW and generation from renewables by about 31.8 GW. A breakdown of the installed capacity of thermal power plants by sources shows that capacity for petroleum and LNG is expected to decrease, but capacity for coal is expected to increase- which, when calculated, reveals that the entire increase in the installed capacity of thermal power will come from coal-fired power plants.

Installed Capacity (National Total)

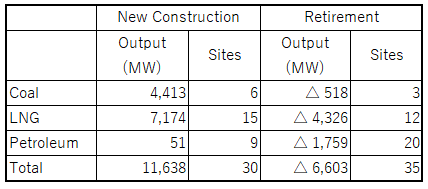

Construction and retirement plans show no changes in power suppliers’ policy to increase dependence on coal

In the plans specified in the previous FY’s Aggregation for the construction and retirement of thermal power plants, the retirement of power plants using petroleum will proceed significantly, while the number of planned constructed and retired power plants using LNG will be nearly equal with outputs remaining constant. However, for this FY’s Aggregation, the outputs from retired power plants using LNG will decrease by about 3.3 GW compared to previous FY’s Aggregation. For the coal-fired power plants, the power suppliers are adding new plants while maintaining obsolete and inefficient ones, demonstrating power suppliers’ policy to maintain a high level of dependence on coal, as seen in the previous FY’s Aggregation.

Planned construction and retirement of power plants

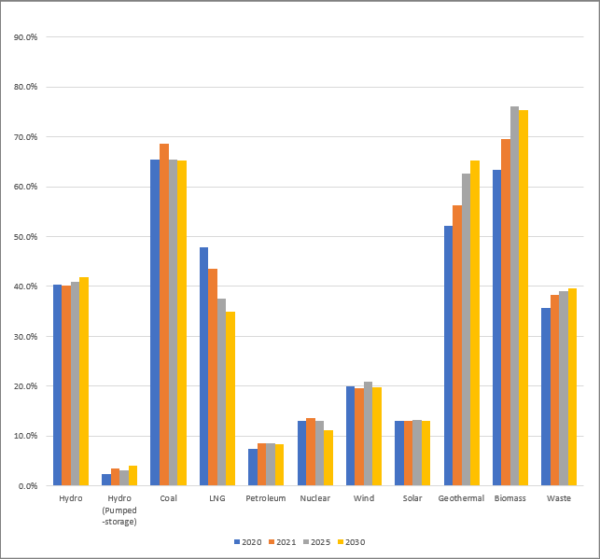

Coal-fired thermal power facility utilization rate to remain at about 70%

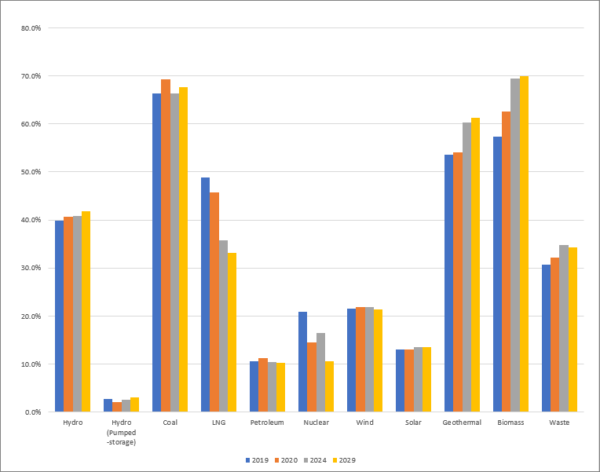

In addition, examining the capacity factor of each power generation source shows that the capacity factor of coal-fired power plants is expected to remain steady at about 65%, while the capacity factor for LNG power plants will decrease by 13% (from 47.9% in 2020 to 33.1% in 2030), showing the plan to prioritize coal over LNG remains unchanged from the plans of the previous FY’s Aggregation.

Projected trends of capacity factor by power generation source

On the other hand, in contrast to the previous FY’s Aggregation, this FY’s Aggregation anticipates a more gradual decline in the capacity factor of LNG in the future, and an increase in the capacity factor of geothermal and biomass. In the case of nuclear power, in the previous FY’s Aggregation, the capacity factor was expected to decrease from 20% to 10%. However, in this FY’s Aggregation, power suppliers are expecting it to remain at just over 10%, which indicates they are planning for a lower level of nuclear power utilization.

Reference: Facility utilization rate by power source (estimated at the time of compilation of the FY2020 supply plan)

Conclusion

In the Aggregation, OCCTO says, “(i)t has become clear that the ratio of coal-fired power plants and nuclear power plants of the net electric power generation (kWh) in FY2030 is about 36% and 4%, respectively, showing divergence from the energy mix”, admitting that the ratio of coal-fired power plants has remained high, and has deviated from its rate stipulated in the energy mix. Their analysis also states that “it is likely that this trend will continue, and unless power suppliers revise their plans in light of further policy initiatives and changes in the business environment, it will be difficult to achieve the energy mix for FY2030”.

Furthermore, after these supply plans were announced, on April 22 Japan announced its greenhouse gas reduction target for 2030, raising it to a 46-50% reduction from FY2013 levels. This inevitably means that there is no option left to continue using coal-fired power plants as of 2030. It is essential for the government to make a drastic shift of its policy toward the total phase-out of coal-fired power plants, rather than just conforming to the existing energy mix, and it will be necessary to send a “coal phase-out” signal to power suppliers as soon as possible.

Reference: Aggregation of Electricity Supply Plans for FY2021 (March, 2021)