The Long-Term Decarbonization Power Source Auction (LTDA), which began in FY2023, aims to “increase the long-term predictability of power supply investment challenges and promote new investment in decarbonized power supply, thereby ensuring supply capacity from decarbonized sources over the long term” toward carbon neutrality by 2050. Created as part of the capacity market, power generation facilities that are contracted through the auction will, in principle, secure fixed capacity payment for 20 years. The first auction was held in January 2024.

The contents of the third auction were recently discussed at the “System Study Working Group, Subcommittee on Next-Generation Electricity and Gas Business Infrastructure, Subcommittee on Electricity and Gas Business, Advisory Committee for Natural Resources and Energy,” and on May 25, a draft of the framework for the third auction was compiled. However, this draft shows that it is hardly an auction at all, but rather seemed to follow the demands of the major electric power companies and give preferential treatment to thermal and nuclear power to an extraordinary degree. Between the soaring cost of electricity, and extending the lifespan of fossil fuel power plants, how much will this cost citizens in the long run?

1.What is the Long-term Decarbonization Power Source Auction (LTDA)?

2.Auction results

3.Proposed 2025 revision

4.Stopping power companies from doing whatever they want

1.What is the Long-term Decarbonization Power Source Auction?

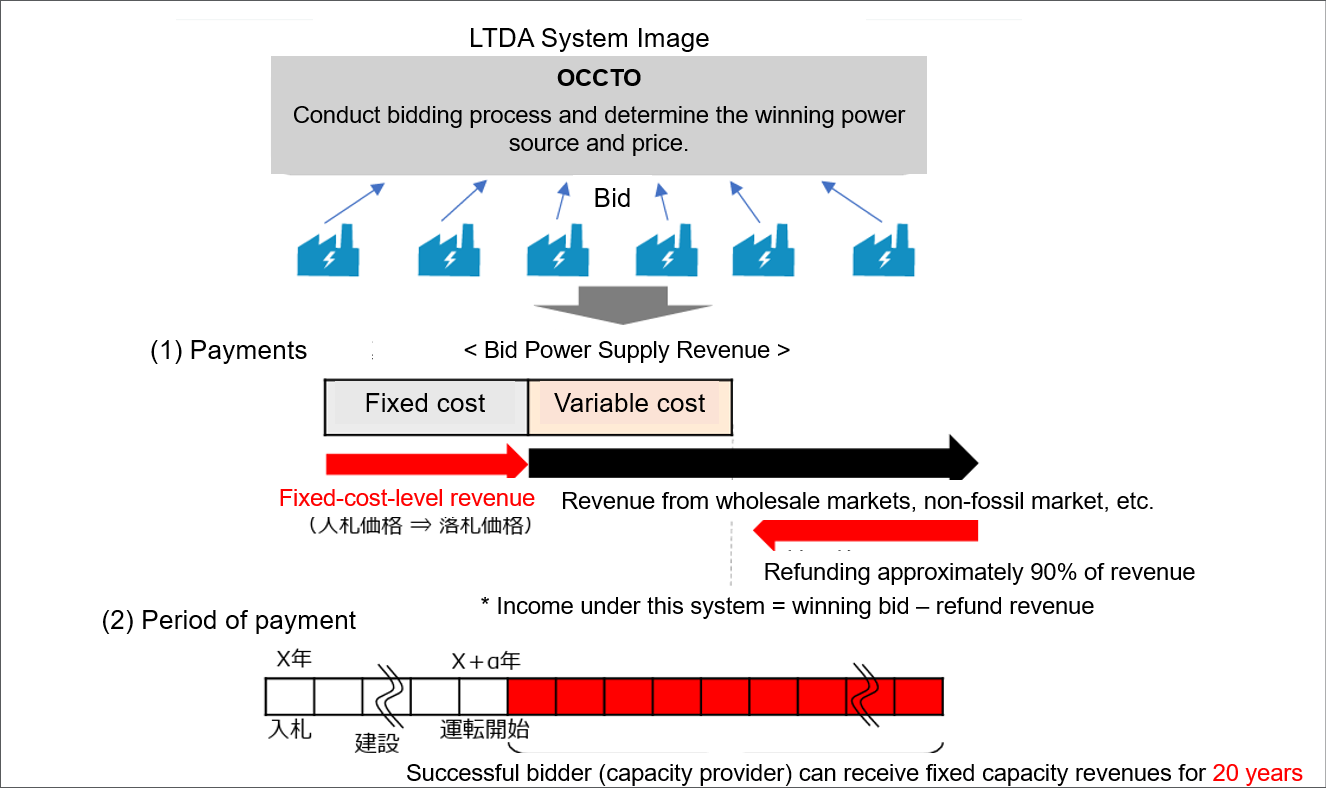

The structure of the LTDA

The LTDA is considered a part of Japan’s capacity market, but it is separate from the main auction of the capacity market, and bids are placed annually for a defined number of open slots. While the main auction in the capacity market is a single-price system in which a uniform agreed price is set for all winning energy sources, the LTDA is a multiple-price system in which the bid price of each bidding energy source is the agreed price, with an offer quota set for each type of energy source and different price caps. The successful bidder (capacity provider) will, in principle, receive capacity revenues at the fixed cost of the power source for 20 years from the start of operation. The capacity provider will receive the amount on a monthly basis, but is required to retroactively refund approximately 90% of the revenue received through other markets (annually).

The auction is administered by the capacity market administrator, the Organization for Cross-regional Coordination of Transmission Operators (OCCTO), and the funds paid to the capacity providers are secured by charging the electricity retailers a calculated amount each year as a “capacity contribution.”

(June 23, 2025).

Eligible power sources

Power sources eligible to participate in the LTDA are “stable and variable power sources that require future capital investment and have not started supplying power at the time of bidding” other than “unabated coal, LNG, and oil-fired thermal power sources”. Not only new construction and replacement, but also ammonia/hydrogen co-firing, and now installation of CCS in existing thermal power plants are also eligible. In the first auction, LNG-fired thermal power sources were solicited separately from “decarbonized power sources,” and determined separately, and the same treatment was applied in the second and third auctions.

As a general rule, “power sources that have already been awarded a bid in the capacity market and power sources that have been certified for FIT or FIP” are excluded. However, “existing thermal power sources that have been awarded a bid in the capacity market main auction without the assumption of decarbonization renovations and that are planning to carry out decarbonization renovations after concluding a capacity securement contract, and power sources that are awarded a bid for the first time in the capacity market main auction in November 2022” are excluded. Essentially, while “double-dipping” with FIT for renewable energy is prohibited, this “double-dipping” is effectively permitted for the renovation of existing thermal power plants, meaning that one thermal power plant is eligible for two auctions.

2.Auction results

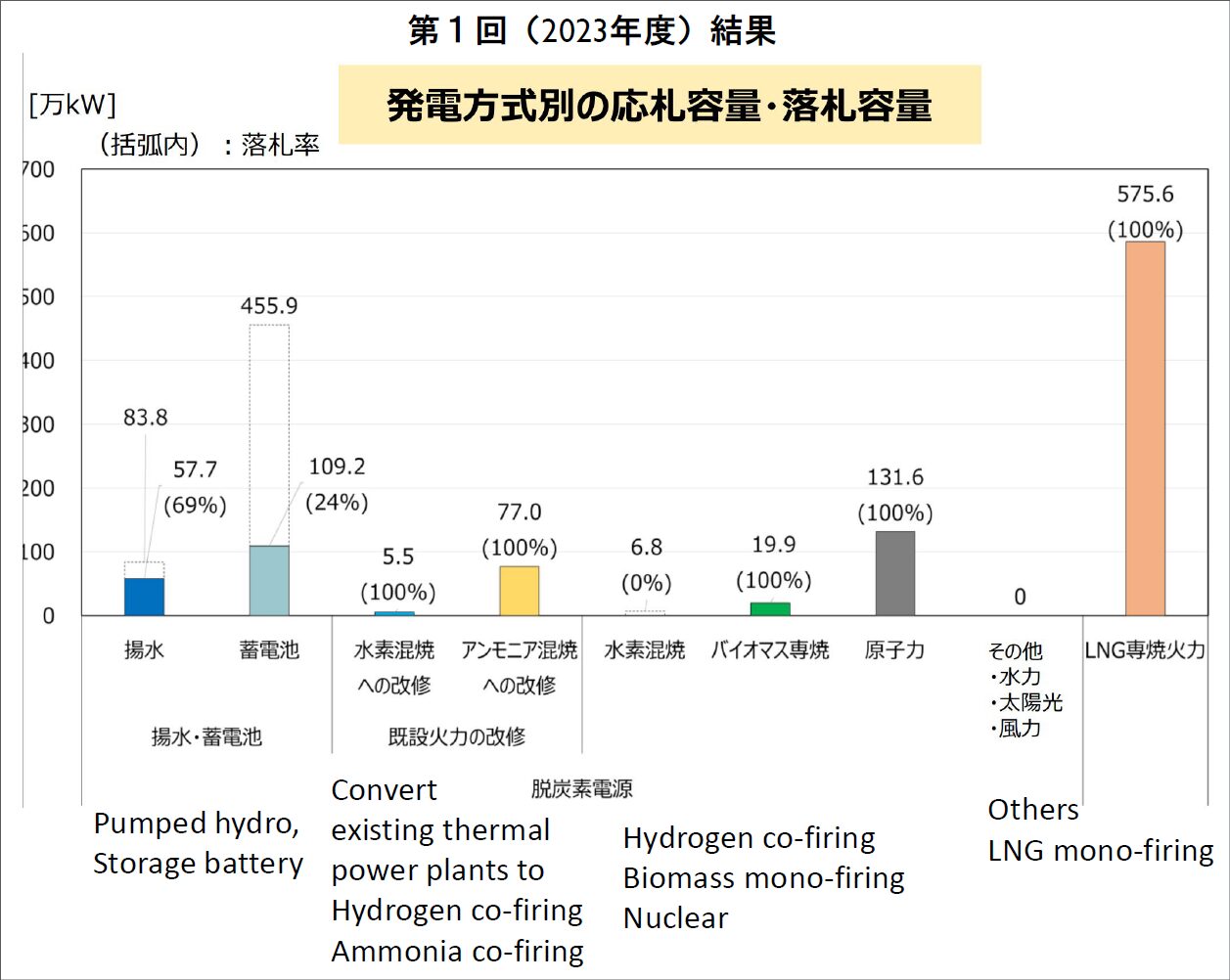

As shown in the table below, the largest number of successful bids in the first auction (FY2023) came from LNG-fired thermal power plants, which were all awarded in the first year of the bidding for the 6 GW quota set aside for the three-year period from FY2023 to FY2025. Moreover, because the quota was filled in the first year, in the following year’s review, it was decided to add an additional 2 GW in each year for the auctions in FY2024 and FY2025.

Although over 4.559 GW of bids were received for storage batteries, less than 1.092 GW were successful (and over 3.467 GW were unsuccessful), indicating that while the majority of bidders for LNG-fired power plants were successful, the competition for storage batteries was fierce over the limited number of open bids. Moreover, the minimum bidding capacity for storage batteries, which was set at 10 MW or more for the first round, was raised to 30 MW or more for the second and subsequent rounds.

After LNG, the next largest bidder in terms of capacity was nuclear power, with the bid for Shimane Nuclear Power Station Unit 3, which has already been constructed. In the renovation of existing thermal power plants, 770 MW of capacity was awarded for renovation to enable ammonia co-firing.

Bid capacity and winning bid capacity at the 1st Auction

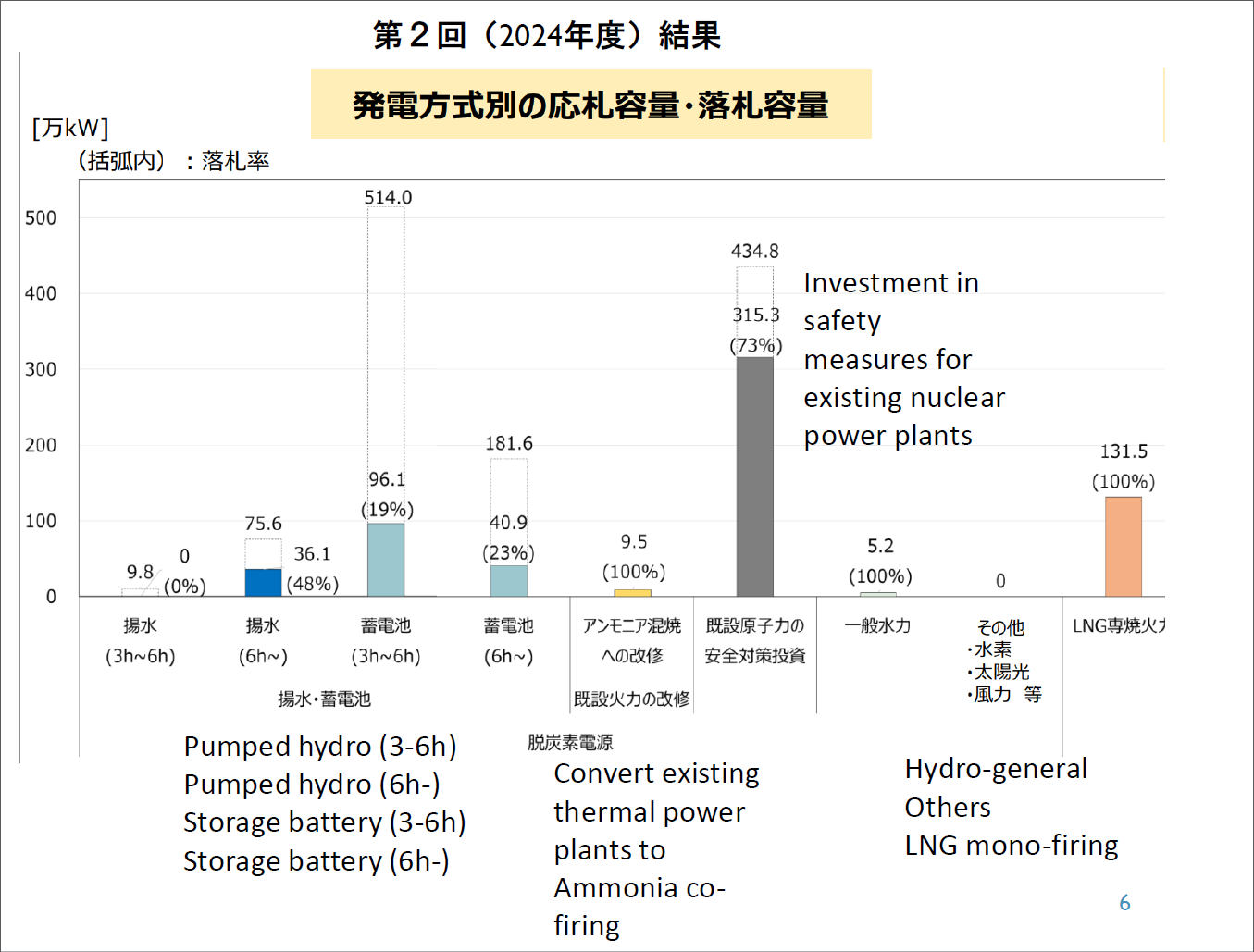

In the second round (FY2024), the bidding deviated from the original objective of “new power source development” and added “investment in safety measures for existing nuclear power plants” as a condition for nuclear power, resulting in the largest bid of 3,153 MW for an existing nuclear power plant. On the other hand, the bid for ammonia co-firing for thermal power generation was only 95 MW for Shikoku Electric Power Company’s Saijo Power Station (coal). For the third auction, a review of the conditions will be conducted.

Bid capacity and winning bid capacity at the 2nd Auction

Furthermore, in both the first and second rounds, there were no bids for solar or wind power, renewable energy sources that should be increased.

3.Proposed 2025 revision

In the draft for the third auction (FY2025) compiled by the Study Working Group, there are proposals to retrofit coal-fired power plants with ammonia co-firing and to take more generous measures for nuclear power. Following are three key points regarding the retrofitting of coal-fired power plants with ammonia co-firing.

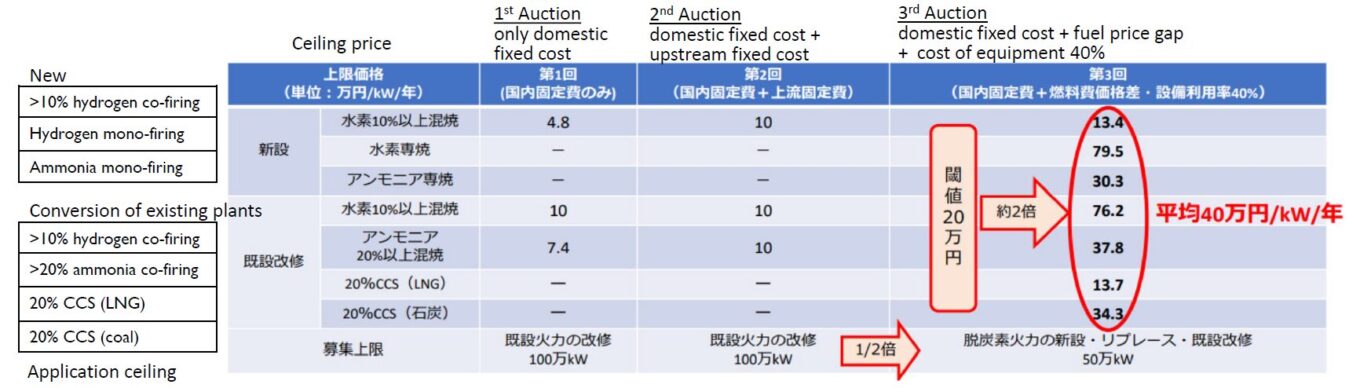

1) Revision of price caps

In previous auctions, the price cap (maximum price threshold) was set at 100,000 yen/kW/year, but it is now set at 200,000 yen/kW/year. However, hydrogen, ammonia, and thermal power with CCS were given further special treatment on the grounds that “these are still nascent energies, and without special consideration of the range of costs and price caps that allow cost recovery, there are aspects of their introduction that will be difficult” and the average price cap was set at 400,000 yen/kW/year (double the threshold).

2) Additional variable costs

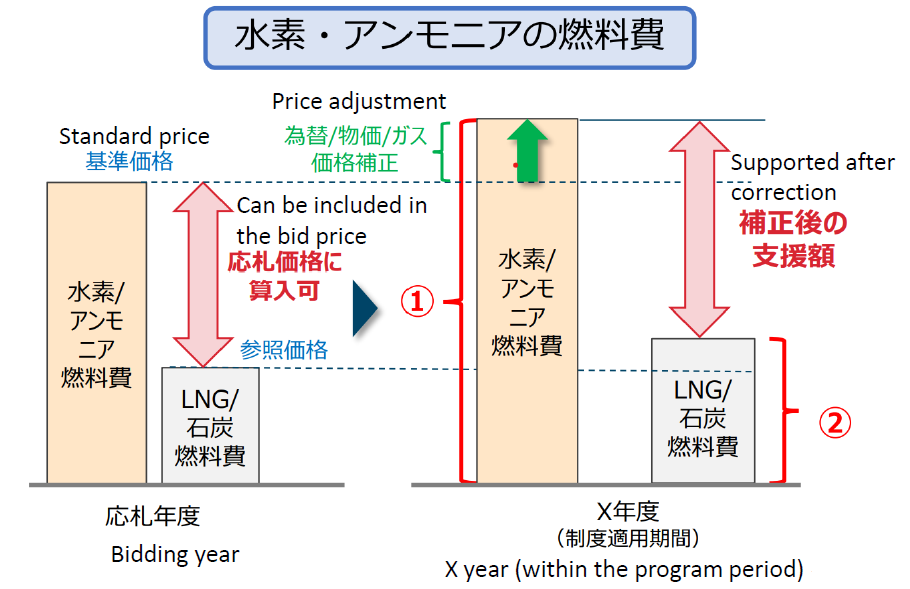

Regarding the revision of the price cap, an amendment has been proposed stating that only hydrogen, ammonia, and CCS can be included in the bid price as “variable costs” in addition to fixed costs. Specifically, it states that “for the fuel cost of ammonia (co-firing and mono-firing), the difference between the fuel cost of ammonia and the fuel cost of coal (calculated based on the annual average price of coal trade statistics of the Ministry of Finance for the year preceding the bid year) for 40% of the annual facility utilization rate of the relevant power source can be added.”

Since ammonia fuel is more expensive than fossil fuels, the Hydrogen Society Promotion Law provides a mechanism to support the higher cost of ammonia fuel. In addition to the existing mechanism, the difference in fuel cost can also be added to the bid price of the LTDA, and the operators can choose which one they prefer at their discretion.

3) Correction of bidding prices

Doubling the maximum price and allowing a special additional fuel cost is too generous toward power companies, but in addition to this, another point was presented: the “correction of bidding prices”. This means that if the fuel costs set in the bidding year rise during the period in which the system is applied after operations begin due to exchange rates or changing prices, the increase will be automatically corrected and paid.

In other words, no matter how much the prices of hydrogen and ammonia rise in the future, power companies will not bear any risk, and all risks and costs will be borne entirely by the “capacity market” system.

If fuel costs rise due to exchange rate fluctuations or other reasons, the difference will be adjusted and supported by the auction system.

4.Stopping power companies from doing whatever they want

The most important step in the fight against climate change is to phase out coal-fired power generation by 2030. Japan must urgently achieve this energy shift in accordance with the rules set forth in international negotiations, which call for decarbonizing the power sector by 2035 and tripling the use of renewable energy.

The development of new power sources should be centered on renewable energy, which the government has decided to introduce to the maximum extent possible. However, the LTDA has no vision to increase renewable energy, and in fact, the conditions are such that even the door for bidding is closed.

Moreover, the LTDA supports the maintenance of existing coal-fired and nuclear power plants and the building of new LNG plants. The amendments introduce an unreasonable system that undermines the very purpose of the auction, which aims to achieve decarbonization, and are clearly intended to reflect the intentions of the power companies and the Ministry of Economy, Trade and Industry, who want to maintain thermal and nuclear power plants. It is no exaggeration to say that the proposals, which double the price caps for hydrogen, ammonia and CCS, allow for the inclusion of variable costs such as fuel costs, and allow for subsequent corrections to the bidding price, are in effect fulfilling all of the power companies’ requests.

The members of the working group that reviewed the LTDA consisted of academics and others, but the major electric power companies, who participated as observers each time, were free to speak freely, and the process was carried out in a manner that they agreed with. Under the guise of “enhancing the long-term predictability of business operators,” the working group has created a mechanism that allows the electric power companies to do whatever they want.

As mentioned at the beginning of this article, the money paid to these electricity suppliers will eventually be added to consumers’ electricity bills several years in the future, and will accumulate every year. This is an issue that should be discussed by the nation, as it is important to debate whether it is necessary to revise this system, which is being implemented in a way that further benefits electric power companies but does not include any estimate of the future costs.

Public Comments on the Subcommitee on Electricity and Gas Business, Subcommittee System Review Working Group 20th Interim Report (Draft) [In Japanese only]

Submission Deadline: July 24, 2025 11:59pm (JST)