The International Energy Agency (IEA) published its annual World Energy Outlook for 2024, and while the future is uncertain due to expected increases in oil and LNG supplies, the report noted that the demand for fossil fuels would be projected to peak in 2030. IEA Executive Director Fatih Birol stated, “In energy history, we’ve witnessed the Age of Coal and the Age of Oil – and we’re now moving at speed into the Age of Electricity.” Regarding energy security, the IEA expresses concerns that regional conflicts and geopolitical strains, such as conflicts in the Middle East and Russia, remain a major risk to the world.

Geopolitical Risks

The report emphasizes that the escalating conflict in the Middle East and Russia’s ongoing war in Ukraine pose continued risks for both energy security and coordinated action on reducing emissions. In addition, it sees these geopolitical risks affecting not only fossil fuel markets, but also supply chains as we transition to clean energy.

It also emphasizes that energy security and climate action are inextricably linked, and that it is imperative to build a new energy system.

Expansion of Renewable Energy

Clean energy is expanding at an unprecedented rate. More than 560 gigawatts (GW) of new renewables capacity was added in 2023, but deployment is far from uniform across technologies and countries. Investment flows to clean energy projects are approaching USD 2 trillion each year, almost double the combined amount spent on new oil, gas and coal supply. While energy demand is rising in emerging and developing countries, the ongoing transition to renewable energy indicates that the global economy can continue to grow without the use of additional fossil fuel energy by the end of the decade.

Demand for Fossil Fuels will be Peak Out

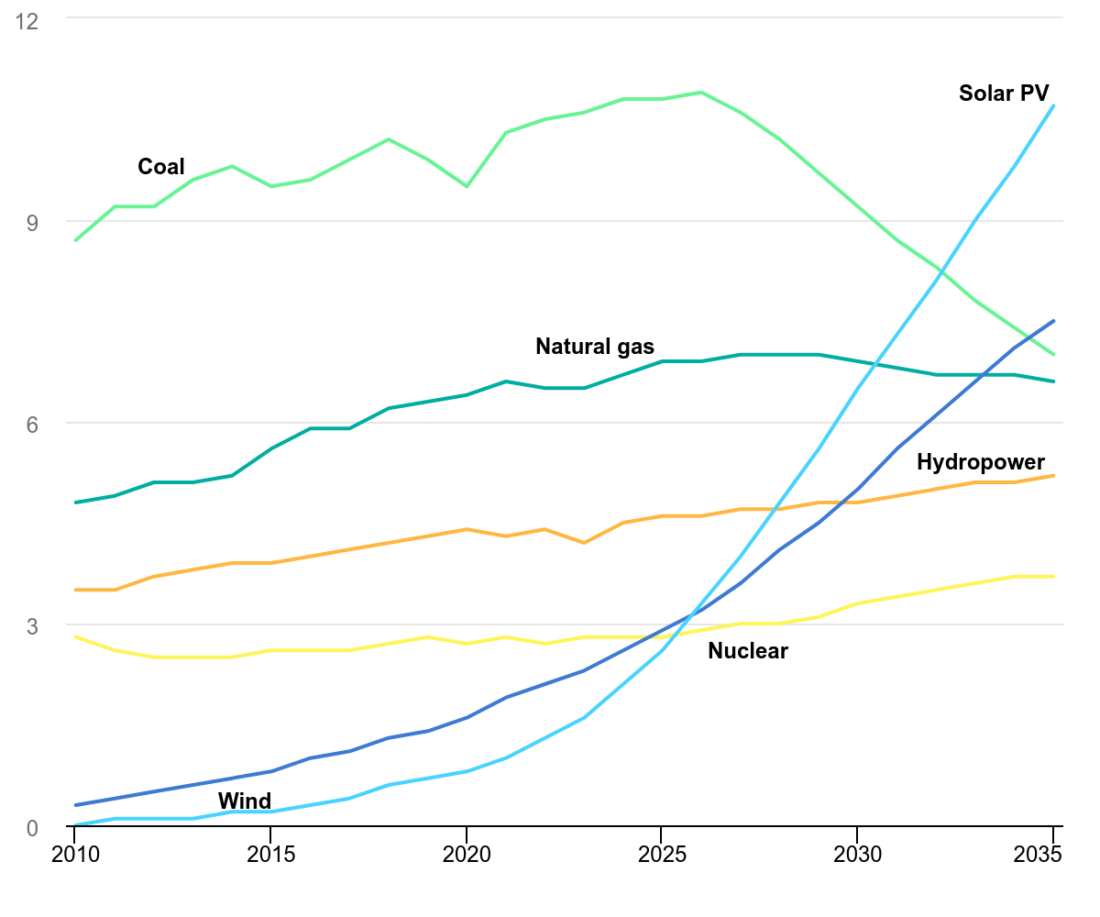

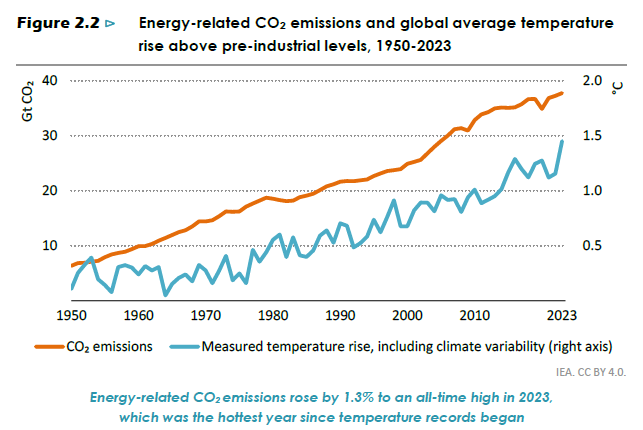

Based on current policies, the IEA estimates that clean energy expansion is strong enough to peak out all three fossil fuels’ (oil, coal, gas) demand by 2030, meaning low-emission sources are set to generate more than half of the world’s electricity before 2030. Although a record high level of clean energy has come online globally, two-thirds of the overall increase in energy demand in 2023 was met by fossil fuels, and energy-related carbon dioxide (CO2) emissions reached a record high. However, growth in clean energy and changes in the structure of the global economy are beginning to constrain overall energy demand growth. Thus, continued growth in global energy demand post-2030 can be met solely with clean energy.

Electricity use has grown at twice the pace of overall energy demand over the last decade, with two-thirds of the global increase in electricity demand over the last ten years coming from China. Today, we cannot talk about energy without the developments in China. China’s solar expansion is rapidly proceeding, and by the early 2030s, China’s solar power generation alone could exceed the total electricity demand of today’s United States.

The capacity of renewable power generation is expected to rise from 4,250 GW today to nearly 10,000 GW in 2030 according to the STEPS* scenario, which is short of the tripling target set at COP28 but more than enough, in aggregate, to cover the growth in global electricity demand and push coal-fired generation into decline. Although the STEPS scenario sees a threefold increase in renewables that brings fossil fuel use down from 80% of total energy demand in 2023 to 58% in 2050, this fall is not enough. By 2035, clean energy is expected to meet 40% of global energy demand in the APS scenario, and this rises to nearly three-quarters by 2050. In the NZE scenario, clean energy meets 90% of global energy demand in 2050.

However, the report pointed out that the expansion of renewable energy requires not only investment in power generation facilities, but also investment in infrastructure such as power transmission and distribution networks, as well as policy support.

World electricity generation in the Stated Policies Scenario, 2010-2035

CO2 Emissions

Despite progress in the energy transition, there is concern that the world could be on course for a rise of 2.4°C in global average temperatures by the end of the century (2100), well above the Paris Agreement goal of limiting global warming to 1.5°C. Based on current policies, global carbon dioxide emissions are set to peak imminently, but atmospheric CO2 will not sharply decrease. What the outcome will affect on the energy market and the earth will depend on consumer choices and government policies.

Energy related CO2 emissions and global average temperature rise above pre-industrial levels, 1950-2023

LNG (Liquefied Natural Gas)

Around 270 billion cubic metres (bcm) of annualised new LNG capacity has been approved and, if delivered according to announced schedules, is set to enter into operation over the period to 2030, a huge addition to global supply. Existing LNG export capacity and new capacity under construction is sufficient to meet projected demand in the STEPS scenario until 2040. There are fewer buyers that are obliged to take volumes of gas on long-term take-or-pay contracts, and around one-third of the capacity under construction is as-yet uncontracted. There is a high degree of uncertainty about which markets and sectors have the capacity to absorb these additional volumes of gas.

According to the report, without lower clearing prices lower than STEPS’ projections, higher electricity demand, and slower energy transitions, it will be difficult for the gas markets to absorb all the prospective new LNG supply and to continue to grow past 2030. It also points out that any acceleration of global energy transition towards the outcomes projected in the APS or NZE scenarios, or a wild card for supply like a large new Russia-China gas supply deal, would exacerbate the LNG glut.

Toward “the Age of Electricity” – to 2050 net zero

The report states that, while geopolitical risks will persist in the coming years, projections based on current government policy decisions indicate that an overhang of oil and liquefied natural gas (LNG) supply will come into view during the second half of the 2020s, alongside a large surfeit of manufacturing capacity for some key clean energy technologies, notably solar PV and batteries. Dr. Birol states, “we’ve witnessed the Age of Coal and the Age of Oil – and we’re now moving at speed into the Age of Electricity.”

Regarding recent focus on the increase in electricity demand due to data center expansion, IEA expects data centers to account for a relatively small share of overall electricity demand growth to 2030, although there will be some impact on the regional electricity market. However, one concern is that the increased use of air conditioners due to more frequent and intense heat waves and prolonged warmer temperatures caused by extreme weather conditions will produce significantly greater variations in projected electricity demand than an upside case for data centers.

The world is still a long way from a trajectory aligned with its net zero goals. All the actions taking place are vital to efforts to decarbonise electricity and achieve the COP28 goal of transitioning away from fossil fuels in line with net zero emissions by 2050. Necessary stronger policies and large-scale investments are increasing to accelerate and expand the transition to a more secure and sustainable energy system.

Currently in Japan, policies have not caught up with the development of infrastructure essential for the expansion of renewable energy and the preferential connection of renewable energy. The IEA report emphasizes the need to increase investment in these areas to robustly decarbonize the power sector, which will require a rebalancing of power sector investment towards grid and battery storage in order to expand renewable energy.

The world is still a long way from a trajectory aligned with its net zero goals. All the actions taking place are vital to efforts to decarbonise electricity and achieve the COP28 goal of transitioning away from fossil fuels in line with net zero emissions by 2050. Necessary stronger policies and large-scale investments are increasing to accelerate and expand the transition to a more secure and sustainable energy system.

Currently in Japan, policies have not caught up with the development of infrastructure essential for the expansion of renewable energy and the preferential connection of renewable energy. The IEA report emphasizes the need to increase investment in these areas to robustly decarbonize the power sector, which will require a rebalancing of power sector investment towards grid and battery storage in order to expand renewable energy.

*IEA’s 3 Scenarios

The World Energy Outlook describes the outlook for the global energy mix through 2050 in the following three scenarios:

- Stated Policies Scenario (STEPS): This scenario provides a sense of the prevailing direction of travel for the energy sector based on a detailed reading of the latest policy settings in countries around the world.

- Announced Pledges Scenario (APS): This scenario starts from the same detailed reading of government policies but takes a different view on their implementation.

- Net Zero Emissions by 2050 (NZE) Scenario: This scenario portrays a pathway for the global energy sector to achieve net zero CO2 emissions by 2050 which is consistent with limiting long-term global warming to 1.5 °C with limited overshoot (with a 50% probability).

IEA’s “Global Gas Security Review 2024” report

Prior to the World Energy Outlook, the IEA released on October 3 the “Global Gas Security Review 2024”, a report on the state of natural gas supply. According to the report, global gas demand for the full year of 2024 is forecast to grow by more than 2.5% and reach a new all-time high of 4,200 bcm. The Asia Pacific region is expected to account for almost 45% of incremental global gas demand. Industry and energy use is emerging as the primary driver behind stronger gas use and is projected to contribute more than half of demand growth. It noted LNG shipping constraints emerged across the Panama Canal and the Red Sea.

Natural gas demand growth picks up in 2024 amid uncertainties over supply (Link)

Related Links

IEA Press Release:Geopolitical tensions are laying bare fragilities in the global energy system, reinforcing need for faster expansion of clean energy

Report Download page:World Energy Outlook 2024

Written/Published: International Energy Agency (IEA)

Published: October 16, 2024