On November 12, the International Energy Agency (IEA) released its flagship World Energy Outlook report, projecting that global electricity demand will outpace previous growth expectations. This report warns that explosive demand growth for artificial intelligence (AI) and data centers is driving up electricity use in advanced economies. It also notes that vulnerabilities in the supply chain for critical minerals are becoming visible amid new security challenges during the energy transition.

The report expresses concern that climate change goals are even more difficult to achieve and that the momentum to reduce greenhouse gas emissions has weakened, considering that 2024 was the hottest year on record and the first year in which global temperatures exceeded 1.5°C above pre-industrial levels.

Since 2000, coal has been the fastest growing fossil fuel in the global energy mix. Global coal demand has nearly doubled since then, and reached the record level of 6,090 million tonnes of coal equivalent (Mtce) in 2024. In advanced economies, however, coal demand has fallen by around 40% since 2015. It declines by a further 35% to 2035 as old coal-fired power plants are gradually retired: coal use in power falls by around 45% to 2035. In the Current Policies Scenario (CPS), coal demand is expected to decline due to the expansion of renewable energy sources. However, this trend will be gradual and subject to significant fluctuations in emerging economies, such as China and India.

“Age of Electricity” and “Critical Minerals”

The IEA presents several scenarios to predict the future of energy: the Current Policies Scenario (CPS), the Stated Policies Scenario (STEPS), and the Net Zero Emissions by 2050 (NZE). There are several common key trends among these scenarios.

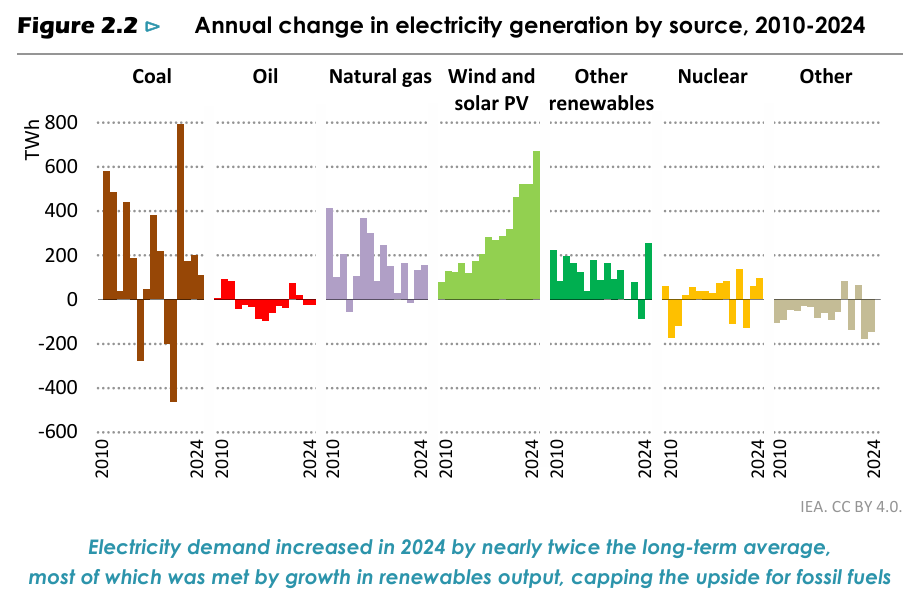

Firstly, the arrival of the Age of Electricity. Electricity demand grows much faster than overall energy use in all scenarios. Demand growth comes in varying proportions from air conditioners, electric vehicles (EV), and especially the explosive growth in electricity demand for data centres and AI-related businesses. The IEA estimates that investment in data centers will exceed the amount spent on global oil supplies by 2025.

On the other hand, the IEA strongly warns that delays in developing new grids, storage, and other sources of power system flexibility are becoming a serious bottleneck in the “Age of Electricity.” Investments in electricity generation have charged ahead by almost 70% since 2015 to reach USD 1 trillion per year, but annual grid spending has risen at less than half the pace to USD 400 billion. This increases congestion, delays the connection of new sources of electricity generation and demand, and pushes up electricity prices.

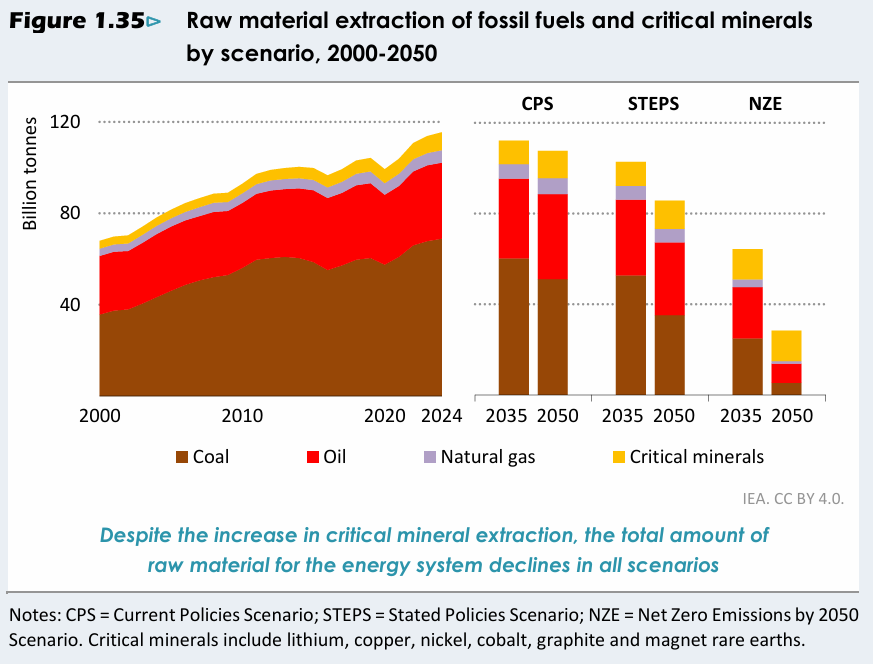

The second key trend is a vulnerability of supply chains for critical minerals. The critical minerals are vital for power grids, batteries and electric vehicles (EVs), but they also play a crucial role in AI chips, jet engines, defence systems and other strategic industries. The extreme concentration of that refining process in specific countries (particularly China) is a matter of concern. The IEA points out that China is the dominant refiner for 19 out of 20 energy-related strategic minerals, with an average market share of around 70%. As of November 2025, more than half of these strategic minerals are subject to some form of export controls, and the IEA suggests that strong policy efforts are needed to diversify and strengthen supply chains of critical minerals.

Energy demand center is shifting to emerging Asia

The report also emphasizes that the “center” in the global energy market is shifting from China—which accounted for 60% of electricity demand growth since 2010—to emerging economies, led by India, Southeast Asia, the Middle East, Latin America, and Africa.

Furthermore, mapping the new geography of demand onto the distribution of global energy resources, the report shows that, by 2035, 80% of global energy consumption growth occurs in regions with high-quality solar irradiation. This suggests that the geographic landscape of the upcoming energy transition will undergo significant change.

Outlook by Energy Source: Renewables Expand, LNG Faces Oversupply Concerns

The outlooks vary depending on the energy source, but several common trends emerged.

Renewable energy: Renewables grow faster than any other major energy source in all the scenarios, led by solar PV. New technologies are entering the system at speed, and renewables set new records for deployment in 2024 for the 23rd consecutive year.

Nuclear energy: After more than 20 years of stagnation, investment in nuclear power is reviving. Investment is rising in both traditional large-scale plants and new designs, including small modular reactors (SMRs). IEA expects that global nuclear power capacity is set to increase by at least a third by 2035.

LNG : Final investment decisions for new LNG projects have surged in 2025, adding to the expected wave in natural gas supply in coming years and promising lower international prices. The new annual LNG export capacity scheduled to start operation by 2030, will reach unprecedented levels, a 50% increase in available global LNG supply. Around half is being built in the United States, and a further 20% in Qatar, followed by Canada and others. Meanwhile, the IEA suggests the risk of oversupply, questions that are still lingering about where all the newly supplied LNG will go.

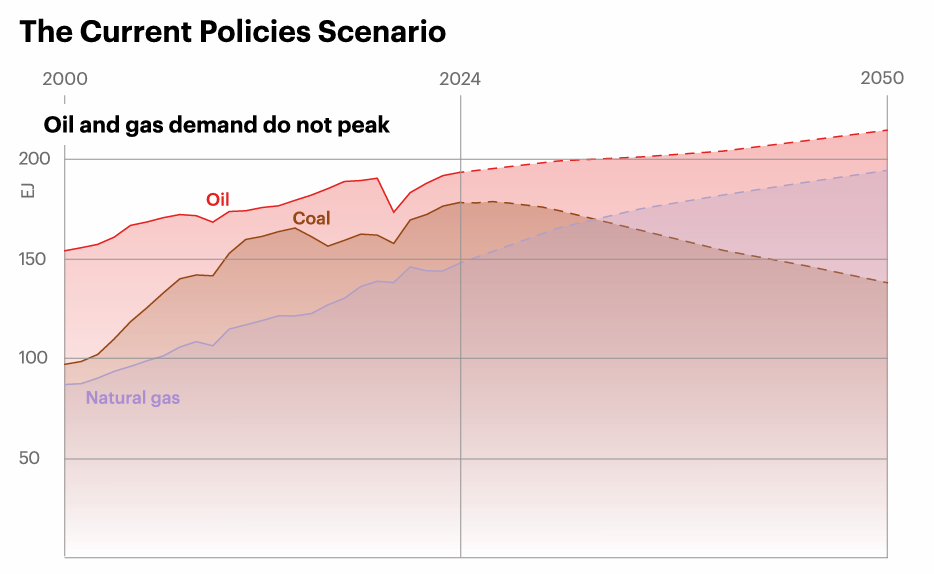

Oil: In the CPS, demand for oil and natural gas continue to grow to 2050. In the STEPS, oil use is predicted to be flattening around 2030.

The Future of Coal Demand

According to the report, 2024 saw record-high consumption levels for oil, natural gas, and coal.

In particular, since 2019, coal demand has increased at 1.5 times the rate of natural gas — the next fastest growing fossil fuel – mainly led by China. The IEA points out that this is the main reason energy-related CO2 emissions reached a record high (38 gigatons annually).

The power sector currently accounts for around two-thirds of global coal demand. Driven mainly by China, since 2019 demand for coal has grown 50% faster than the next fastest growing fossil fuel, natural gas, a key reason why energy-related emissions have continued to grow. The dynamics in coal markets are determined by a handful of major emerging and developing economies, with China, India, Indonesia and other countries in Southeast Asia. Meanwhile, coal demand has fallen in advanced economies. Given this situation, the IEA emphasizes that approximately half of global coal demand is used for power generation in emerging and developing countries. Future prospects will be heavily influenced by electricity demand in these countries, whether the current momentum of renewable energy persists, and whether LNG can enter the market at competitive prices.

These are the coal demands predicted by each of the three scenarios.

CPS: If current policies continue, coal demand will fall by the late 2020s, though at a gradual pace. Furthermore, the IEA warns that in this scenario, if grid integration stalls and the deployment of solar and wind power stagnates, coal demand could remain elevated, risking a further delay in its decline.

STEPS: Renewables capacity additions in emerging and developing economies, averaging more than 600 GW per year, is expected to drive a steady decline in global coal demand if the policies and targets already announced by governments are implemented. There is limited further growth in coal demand in the STEPS.

NET: In the most ambitious scenario aiming for net-zero by mid-century, coal demand will decline rapidly alongside other fossil fuels.

Achieving 1.5°C target is getting harder

In 2024, energy-related CO2 emission reached a record high and the global average temperature exceeded 1.5°C for the first time. The IEA concludes overshoot of the 1.5°C target is now inevitable in any scenarios, including those with very rapid emissions reductions.

Under the CPS, a temperature rise of approximately 3°C is projected by 2100, while the STEPS also anticipates a 2.5°C increase.

Even under the NEZ, temperatures would exceed 1.5°C for decades. Thereafter, in addition to very rapid progress with the transformation of the energy sector, bringing the temperature rise back down below 1.5 °C is required through widespread deployment of CO2 removal (CDR) technologies that are currently unproven at large scale.

Conclusion

This report listed various countermeasures – to boost the uptake of wind, solar, hydropower, geothermal, nuclear power and other low-emissions technologies; to improve energy efficiency; to increase the electrification of end-uses; and to use sustainable fuels like low-emissions hydrogen or technologies like carbon capture, utilisation and storage (CCUS) in cases where electrification is not practicable. These measures can significantly reduce greenhouse gas emissions and are highly cost-effective. Under the STEPS, IEA expects that renewable energy gets close to achieving the tripling in renewables capacity by 2030, a target adopted at COP28, with a rise to 2.6-times the 2022 levels.

It has been clearly shown once again that accelerating the adoption of renewable energy and improving energy efficiency, including the transition away from coal-fired power, is an urgent priority.

IEA Report: World Energy Outlook 2025

IEA PR: As risks multiply in a world thirsty for energy, diversification and cooperation are more urgent than ever

Written/Published by: International Energy Agency (IEA)

Published: November 12, 2025