Global Energy Monitor and co-authoring organizations have released their annually updated report “Boom And Bust Coal 2024”.

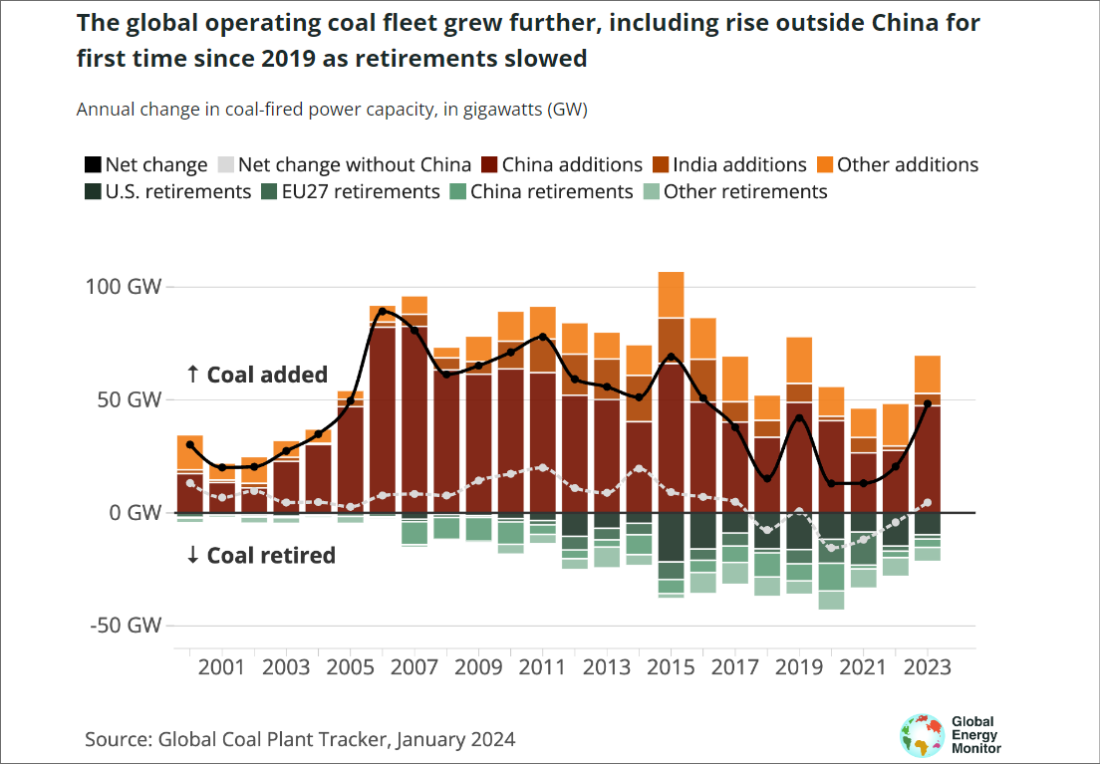

After signing of the Paris Agreement, the Glasgow Climate Pact agreed to in 2021 emphasized the goal to pursue efforts to limit the increase in global average temperature in this century to within 1.5°C above pre-industrial levels. Many countries are now working on ambitious measures to achieve this, but the data in the Global Coal Plant Tracker* shows that in 2023, 69.5 GW of coal power capacity was commissioned and 21.1 GW retired, resulting in a net annual increase of 48.4 GW of coal power for the year and a global total capacity of 2,130 GW.

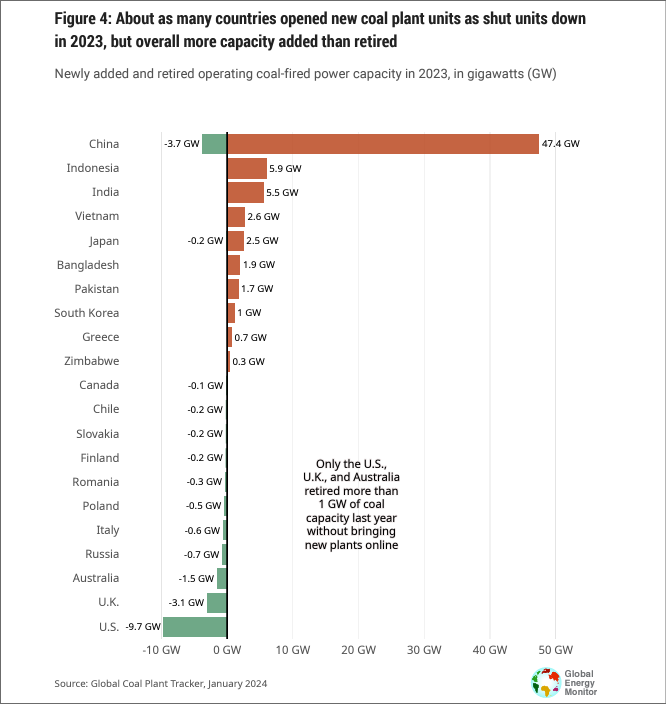

This is the highest net increase in operating coal capacity since 2016. The main reason for this increase was the surge in new coal plants coming online in China (47.4 GW), but in Japan, 2.5GW of new coal plants started operation in 2023.

*The data comes from GEM’s Global Coal Plant Tracker, an online database updated biannually that identifies and maps every known coal-fired generating unit and every new unit proposed since January 1, 2010 (30 MW and larger).

The report shows that, in 2023, nearly as many countries began operating new coal-fired power plants as retired them, indicating that overall there was more generating capacity added than coal-fired power plants decommissioned. Only the U.S., U.K. and Australia retired more than 1 GW of coal capacity last year, but increases in 10 other countries, including China and Japan, boosted global generation capacity.

Key Findings of the Report

- The Group of Seven (G7) major industrial countries accounts for 15% (310 GW) of the world’s operating coal capacity, down from 23% (443 GW) in 2015. With the completion of new units in Japan in 2023, the G7 no longer has any coal in construction but is still home to one proposal in Japan and two in the U.S.

- The Group of Twenty (G20) is home to 92% of the world’s operating coal capacity (1,968 GW) and 88% of the pre-construction coal capacity (336 GW).

- China and the ten countries following it account for 95% of the global pre-construction capacity. The remaining 5% is distributed among 21 countries, eleven of which have only one project and are on the brink of achieving the “no new coal” milestone.

- In 2023, the decrease in proposed coal outside of China was tempered by 20.9 GW of entirely new proposals, led by India (11.4 GW), Kazakhstan (4.6 GW), and Indonesia (2.5 GW), as well as 4.1 GW of previously shelved or canceled capacity considered proposed again.

The report points out that Japan does not have a planned coal phase-out target, and only a meager 1.9 GW of operating capacity has a planned future retirement date, highlighting the country’s hesitance to embrace a transition to renewable energy. Although Japan has set a “net zero 2050” target, fossil fuels still accounted for more than 70% of power generation in Japan in FY 2022 (33.7% natural gas, 30.8% coal, 8.2% oil). This underlines that Japan is the most dependent on coal among the G7 countries and just how slow its expansion of renewable energies has been compared to its G7 counterparts and other neighboring countries.

Currently, discussions have started on the revision of Japan’s Strategic Energy Plan. It is important to see what revisions will be made to reduce coal reliance and accelerate expansion of renewable energy from the current 6th Strategic Energy Plan, which plans to continue using coal for 19% of Japan’s power generation even in FY2030, while renewable energy for only 36-38%.

Report Downloads :

Boom and Bust Coal 2024(Japanese Summary, PDF)

Boom and Bust Coal 2024 (Down road site, English)

Global Energy Monitor Release document for Japaese market(English PDF/Japanese PDF)

Written/Published:

Global Energy Monitor, Centre for Research on Energy and Clean Air (CREA), E3G, Reclaim Finance, Sierra Club, Solutions for Our Climate, Kiko Network, Climate Action Network (CAN) Europe, Bangladesh Working Group on External Debt (BWGED), Coastal Livelihood and Environmental Action Network (CLEAN), Waterkeepers Bangladesh, Dhoritri Rokhhay Amra (DHORA), Trend Asia, Alliance for Climate Justice and Clean Energy, Chile Sustentable, POLEN Transiciones Justas, Iniciativa Climática de México, and Arayara. Beyond Fossil Fuels also joined the Turkish version of the report.

Published: April 11, 2024