On April 12, Rainforest Action Network and other NGOs released the report “Banking on Climate Chaos 2023”.

The report, which is updated annually, provides a comprehensive analysis of fossil fuel financing and underwriting by the world’s leading private banks, revealing the banks’ involvement as it relates to climate change.

It found that in the seven years following the adoption of the Paris Agreement, 60 of the world’s largest private banks continued to pour huge sums of money into financing fossil fuels, amounting to US$5.5 trillion. The report also showed that in 2022 alone, fossil fuel companies had generated US$4 trillion in profits, while banks had provided US$669 billion in financing.

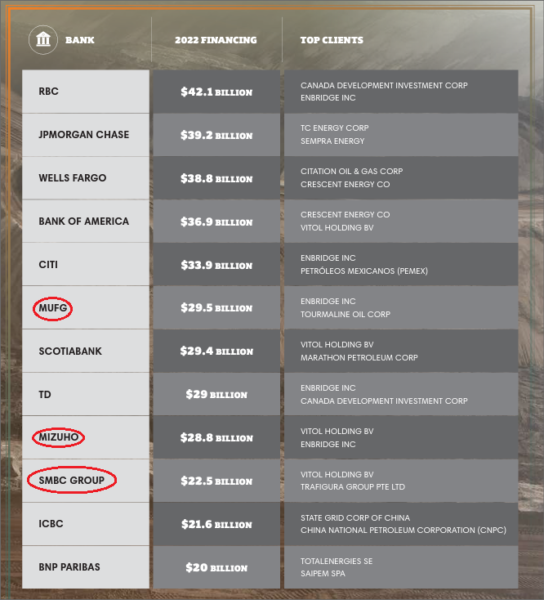

For the first time since 2019, the Royal Bank of Canada (RBC) has surpassed JP Morgan Chase as the biggest annual funder of fossil fuels. It may indicate that Canadian banks are becoming the last resort for fossil fuels, but U.S. banks still dominate fossil fuel financing, accounting for 28% of all fossil fuel financing in 2022.

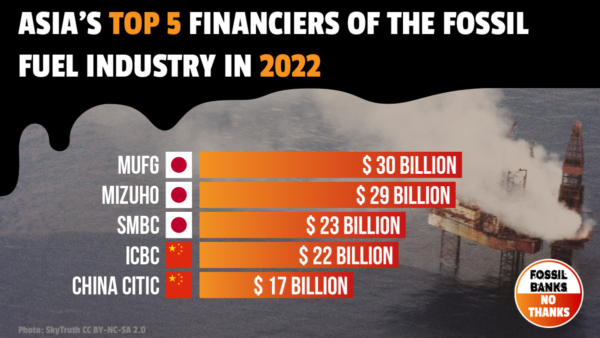

In Asia, three Japanese megabanks dominate the top of the list. They are high in the rankings for overall fossil fuel finance (Mitsubishi UFJ Financial Group ranks 6th, Mizuho Financial Group ranks 8th, SMBC Group ranks 16th), but in addition, all three banks are also included in “The Dirty Dozen 2022,” a list of 12 banks involved with notably problematic fossil fuel companies and projects.

The Dirty Dozen (Unit: Billion US$)

Although the Russian invasion of Ukraine led to calls for a transition to renewable energy, the top 30 companies expanding liquefied natural gas (LNG) have used the crisis to secure nearly 50% more funding in 2022 compared to 2021. Most energy experts agree that the LNG expansion plans in Europe are unnecessary, and new projects would contribute to a supply glut and long-term dependence on this fossil fuel.

Of the financing to the world’s top 30 companies in coal power, 97% of financing was provided by Chinese banks. These companies, which have plans to expand coal power capacity, received $29.5 billion from the profiled banks in 2022.

49 of the world’s 60 largest private banks have pledged to achieve GHG net zero emissions in their investment and loan portfolios by 2050, however most banks’ policies do not strictly exclude lending for fossil fuel expansion, and so they continue to invest in and underwrite their customers (fossil fuel-related companies). Although Japanese megabanks have also committed to achieve net zero emissions, Mizuo FG and SMBC Group were listed in the top banks providing financing to LNG worldwide in 2022, with Mizuho FG showing up in the top for the first time by replacing Morgan Stanley.

The world is already moving beyond coal toward the realization of a decarbonized society, and so banks must fundamentally shift their policies to close the gap between their own goals and the global reality as soon as possible.

We call on the Japanese government, which is lagging behind the rest of the world in phasing out coal power, to press forward with coal-exit measures.

Note:

The annual Banking on Climate Chaos report is authored by Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil Change International, Reclaim Finance, Sierra Club, Urgewald. Over 600 organizations from 75 countries around the world endorsed the report and are calling on banks to stop funding climate destruction.

Report and Press Release

- Press Release from Bank Trak:New report: Canadian bank RBC the #1 financier of fossil fuels, world’s biggest banks continued to pour billions into fossil fuel expansion(Link)

- Press Relase from Oil Change:Banking on Climate Chaos 2023: Fossil Fuel Finance Report(Link)

- Banking on Climate Chaos(downroal report)

Related Link

- Fossil Fuel No Thanks(Link)

Written/Published by: Rainforest Action Network and co-authors

Published: April 12, 2023