Rainforest Action Network (RAN), BankTrack, and other organizations published the 16th annual Banking on Climate Chaos (BOCC) report on June 17.

This report covers the world’s top 65 banks’ lending and underwriting to 2,730 fossil fuel companies. The report revealed that despite the adoption of policies related to “net zero” and other climate change measures over the past few years, global banks have backtracked on many climate-related commitments, with funding provided by banks to the fossil fuel industry reaching $869.4 billion in 2024. This represents an increase of 162.5 billion dollars (23%) compared to 2023. There is no need for any new fossil fuel infrastructure (such as pipelines), transport tankers, oil fields, or any other new sources of fossil fuel supply. However, banks continue to expand their involvement in harmful fossil fuel projects and invest in companies involved in such projects.

Key Findings in 2024

- The 65 biggest banks globally committed $869 billion USD to companies conducting business in fossil fuels in 2024.

- The 65 biggest banks globally committed $429 billion USD to companies expanding fossil fuel production and infrastructure in 2024.

- Over 2/3 of banks covered in this report (45 banks) increased their fossil fuel financing from 2023 to 2024.

- 48 of the 65 banks in this report increased fossil fuel expansion finance from 2023 to 2024.

- More banks pulled back from climate change mitigation policies, presumably contributing to this increase in fossil fuel financing.

- The 65 banks in this year’s report have committed $7.9 trillion USD in fossil fuel financing since 2016, when the Paris Agreement went into effect.

- Since 2021, global banks have financed $1.6 trillion USD to fossil fuel expansion companies. Banks globally committed $429 billion USD to companies engaged in fossil fuel expansion in 2024, an $84.8 billion USD increase from 2023.

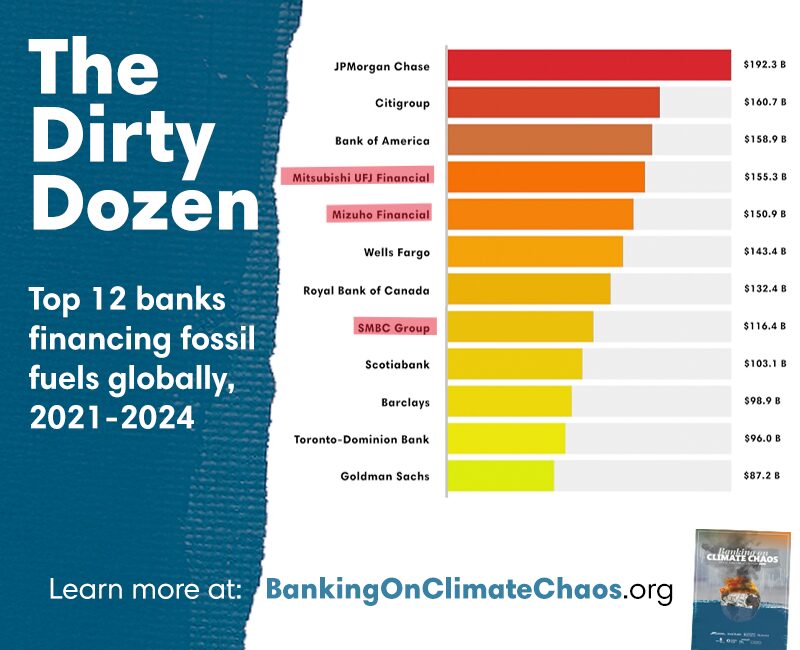

The report shows that certain countries or regions play a significant role in fossil fuel finance globally. In 2024, the Dirty Dozen banks that funded all fossil fuel sectors during the reporting period included megabanks in the United States, Canada and Japan, with banks from Japan and the United States accounting for nine of the Dirty Dozen. Mizuho ($40.3 billion), MUFG ($38.1 billion), and SMBC ($27.9 billion), ranked 4, 6, and 11 for 2024 financing, respectively. Three mega banks headquartered in Japan are contributing 12% of this report’s overall financing for that year. Nearly half of that financing went to companies headquartered in the United States, demonstrating how important Japanese bank financing is for the U.S. energy sector, especially LNG.

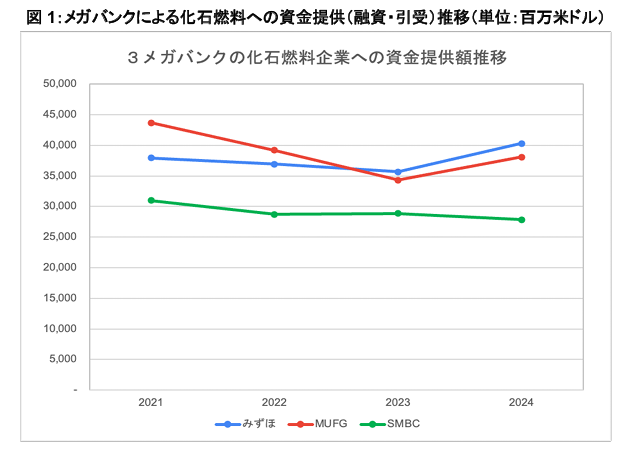

Trends in funding provided by Japan’s three megabanks to fossil fuel companies

As climate change becomes increasingly severe each year, it has become clear that funding for fossil fuels from banks is not decreasing, but actually increasing. In particular, the report indicates that banks provide funds for the development of LNG import/export terminals and related infrastructure facilities. In 2024, banks’ withdrawal from the Net-Zero Banking Alliance (NZBA), a global member-led initiative supporting banks to achieve net-zero greenhouse gas (GHG) emissions from lending and investment portfolios by 2050, drew significant attention. Following the withdrawal of major US banks from the end of 2024, Japan’s three megabanks also withdrew in March 2025, and every one of the US, Canadian and Japanese NZBA member banks included in this report have withdrawn from the alliance. As of publication, less than half (30) of the banks included in this report are still members of the initiative. The NZBA guidelines (3rd edition) published in April this year, has weakened its fundamental 1.5° C target to “well-below 2º C”, which will only lead to further destruction, particularly in vulnerable areas like small island nations.

With this in mind, the authors of this report state that we can no longer rely on voluntary action by banks. It is necessary that financial supervisory authorities, institutions, and policymakers strengthen regulatory measures and take steps to align the activities of financial institutions with climate goals in order to fulfill the commitments of the Paris Agreement.

We must pay close attention to the fact that Japanese megabanks continue to provide huge amounts of funding, both globally and domestically, for fossil fuel financing and loans to fossil fuel expanding companies, thereby supporting their businesses. We must urge these banks to fulfill their responsibility to protect local communities and economies from the growing risks of climate change.

BankTrack PR : Banks fossil fuel finance totals $869 billion in 2024, a dramatic increase in financing

Website:Banking on Climate Chaos, Fossil fuel Finance Report 2025

Report (PDF)

The report is prepared by Rainforest Action Network (RAN), BankTrack, Center for Energy, Ecology, and Development, Indigenous Environmental Network (IEN), Oil Change International (OCI), Reclaim Finance, the Sierra Club, and Urgewald, and endorsed by 480 organizations in 69 countries around the world.

Full data sets – including fossil fuel finance data, policy scores, and stories from the frontlines – are available for download at bankingonclimatechaos.org.

Written/Published: Rainforest Action Network, et al.

Publishing Date: June 17, 2025